- Oil traded near a six-week low

Market news

Oil traded near a six-week low

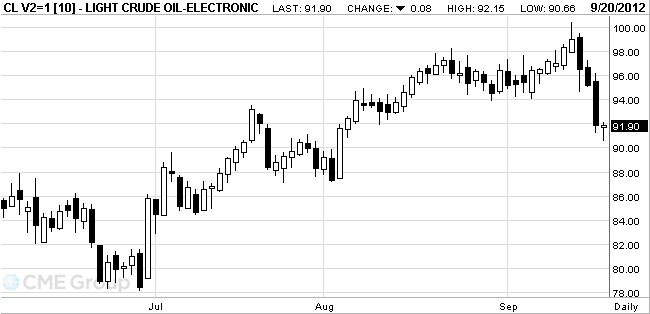

Oil traded near a six-week low after U.S. stockpiles climbed the most since March, Chinese manufacturing shrank and Japanese exports fell, signaling fuel demand may be slowing among the world’s biggest crude users.

Futures were little changed after declining as much as 1.4 percent. U.S. oil inventories surged 8.5 million barrels last week as Gulf of Mexico production resumed after Hurricane Isaac, Energy Department data showed yesterday. China’s manufacturing may contract an 11th month, according to a purchasing managers index by HSBC Holdings Plc and Markit Economics. Japan’s overseas sales fell a third month in August, the Finance Ministry said.

Oil for October delivery slid as much as $1.32 to $90.66 a barrel in electronic trading on the New York Mercantile Exchange, the lowest since Aug. 6.

Brent oil for November settlement rose 51 cents to $108.72 a barrel on the London-based ICE Futures Europe exchange. The front-month European benchmark grade’s premium to the corresponding West Texas Intermediate contract was at $16.68 a barrel. It narrowed to as little as $15.58, the lowest on an intraday basis since July 26.