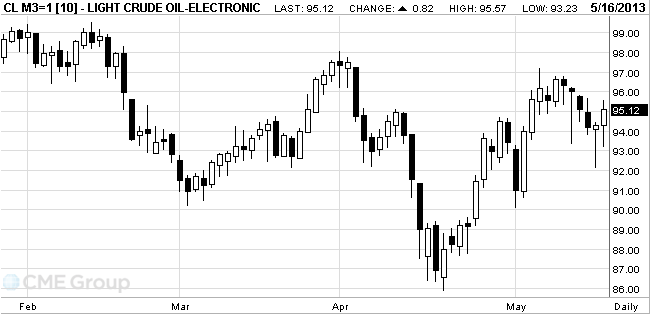

- West Texas Intermediate crude rose

Market news

West Texas Intermediate crude rose

West Texas

Intermediate crude rose on speculation that central banks will bolster stimulus

after more Americans than projected filed applications for unemployment

benefits and

Futures

climbed as much as 1.2 percent as Labor Department figures showed that jobless

claims exceeded all forecasts in a Bloomberg survey of economists. The

WTI oil for

June delivery rose $1.12, or 1.2 percent, to $95.42 a barrel at 11:15 a.m. on

the New York Mercantile Exchange. Prices dropped as much as $1.07 before the

release of the U.S. figures at 8:30 a.m. in Washington. The volume of all

contracts traded was 54 percent above the 100-day average for the time of day.

Brent crude

for June settlement, which expires today, advanced 37 cents, or 0.4 percent, to

$104.05 a barrel on the London-based ICE Futures Europe exchange. The more

actively traded July futures increased 65 cents, or 0.6 percent, to $104.15 a

barrel. Volume for all contracts was 25 percent greater than the 100-day

average.