- European session: the euro is stable in anticipation Draghi comments

Market news

European session: the euro is stable in anticipation Draghi comments

07:00 United Kingdom Halifax house price index May +1.1% +0.2% +0.4%

07:00 United Kingdom Halifax house price index 3m Y/Y May +2.0% +2.5% +2.6%

07:15 Switzerland Consumer Price Index (MoM) May 0.0% +0.1% +0.1%

07:15 Switzerland Consumer Price Index (YoY) May -0.6% -0.6% -0.5%

10:00 Germany Factory Orders s.a. (MoM) April +2.3% -1.0% -2.3%

10:00 Germany Factory Orders n.s.a. (YoY) April -0.4% -0.2% -0.4%

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.50% 0.50% 0.50%

The euro exchange rate is kept in the range after the ECB left policy unchanged. At today's meeting the Governing Council of the ECB decided to leave rates unchanged, in line with the forecast. The bank said that the main refinancing rate, the lending rate and deposit rate will remain unchanged at 0.5%, 1.00% and 0.00%, respectively. Now all the attention is focused on the speech of the Central Bank, Mario Draghi, who will comment on the reasons for the decision at a press conference.

Inhibit the growth of the euro weak data on promzakazy in Germany, which fell more than expected. Orders in the industrial sector in Germany in April ypali by 2.3% compared to the previous month. Economists had expected a decline of 1.0%. In March, the volume of orders increased by 2.3%. In a statement, the ministry said that the volume of orders in April was below average. The demand for industrial goods in Germany in April was disappointing everywhere, especially in the country. The volume of domestic orders fell by 3.2% compared with March. The volume of foreign orders fell by 1.5%, while the volume of orders from the countries of the euro zone fell by 3.6%.

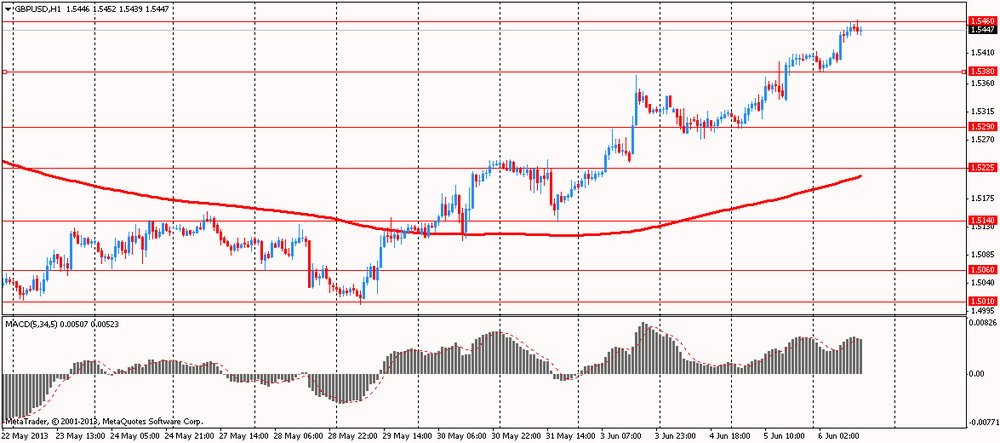

The pound shows a moderate increase against the dollar after the Bank of England's MPC today left interest rates at a record low 0.5%, where it has been since March 2009. He also upheld the asset purchase program at £ 375 billion previously it was increased by £ 50 billion to £ 375 billion in July 2012. Both solutions in line with the main forecast.

Support the pound had data on house prices in the UK, which in May rose at the fastest pace in nearly two and a half years. Activity in the housing market has increased due to a variety of government programs. This is stated in a report released Thursday by the mortgage lender Halifax.

The sales volume remained at the levels observed before the crisis, mainly due to lack of homes for sale. However, according to the government's own program for the housing market from the start of the program has already booked 4,000 houses under construction for two months. House prices rose in May by 0.4% compared to the previous month and by 2.6% compared to the same period last year. Annual growth was most rapid in September 2010. In April, prices rose by 1.1% compared with the previous month and up 2% compared to the same period last year.

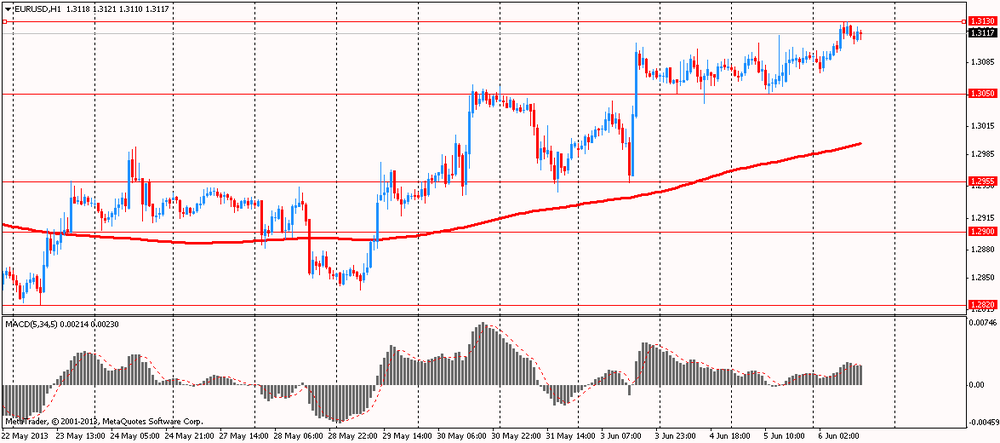

EUR / USD: during the European session, the pair rose to $ 1.3130

GBP / USD: during

the European session, the pair rose to $ 1.5463

USD / JPY: during

the European session, the pair fell to Y98.84

At 12:30 GMT will be the monthly press conference of the ECB. At the same time, in the U.S. there are initial applications for unemployment benefits. At 14:00 GMT Canada is to publish an index of the PMI Ivey (including seasonally adjusted) in May.