- Oil fell from a two-week high

Market news

Oil fell from a two-week high

West Texas

Intermediate crude slid from a two-week high after industrial production slowed

in

Prices fell

as much as 0.9 percent as Chinese output grew 9.2 percent in May, compared with

9.3 percent in April, the National Bureau of Statistics said yesterday. The

pace was less than the 9.4 percent estimate in a Bloomberg survey of

economists. Futures also decreased as production resumed at the North Sea

Buzzard oil field, the largest contributor to the Forties crude grade, a

component of the Brent benchmark.

China used

9.76 million barrels a day, or 11 percent of world’s oil, in 2011, making it

the second-biggest user after the U.S., which used 18.8 million barrels a day,

or 21 percent, according to BP Plc (BP/)’s Statistical Review of World Energy.

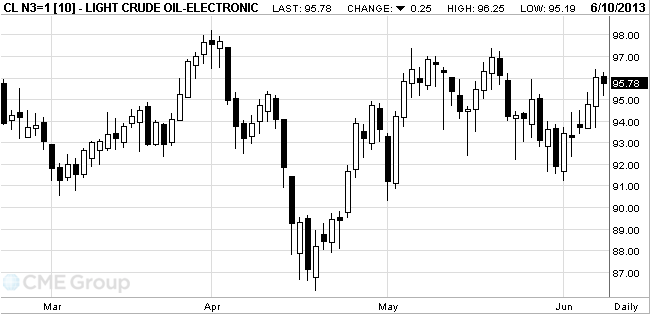

WTI for

July delivery slid 28 cents, or 0.3 percent, to $95.75 a barrel at 10:40 a.m.

on the New York Mercantile Exchange. The volume of all futures traded was 5.8

percent below the 100-day average. Prices advanced $1.27 to $96.03 a barrel on

June 7, the highest close since May 21.

Brent for

July settlement dropped 35 cents, or 0.3 percent, to $104.21 a barrel on the

London-based ICE Futures Europe exchange. Volume was 8.6 percent below the

100-day average.