- Oil climbed to the highest level in nine months

Market news

Oil climbed to the highest level in nine months

West Texas

Intermediate crude climbed to the highest level in nine months on concern that

tension in the

Prices

headed for a second weekly gain after President Barack Obama was said to

authorize lethal military aid to rebel groups in

Obama is

authorizing the provision of small arms and ammunition to the Syrian opposition

under a classified order instructing the Central Intelligence Agency to arrange

delivery of the weapons, according to a

The

decision to arm the opposition was prompted by rebel losses rather than by the

Iranians

went to the polls today to choose a successor to President Mahmoud Ahmadinejad

who may determine whether the international isolation of world’s fourth-largest

oil-reserve holder will continue. Voting was extended by three hours to 9 p.m.

local time, state-run Press TV reported.

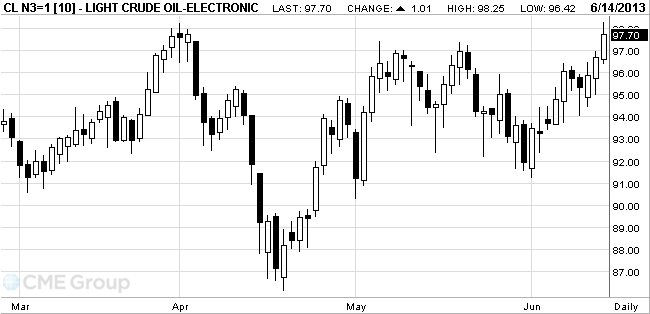

WTI for

July delivery climbed 92 cents, or 1 percent, to $97.61 a barrel at 11:47 a.m.

on the New York Mercantile Exchange. It touched $98.25, the most since Sept.

17, breaching the prior 2013 high of $98.24 on Jan. 30. The volume of all

futures traded was 42 percent above the 100-day average. Prices are up 1.9

percent this week.

Brent for

August settlement increased $1.01, or 1 percent, to $105.96 a barrel on the

London-based ICE Futures Europe exchange. Volume was 17 percent below the

100-day average for the time of day.

Brent’s

premium to WTI for August delivery widened to as much as $8.32 from yesterday’s

$7.56 based on July contracts.