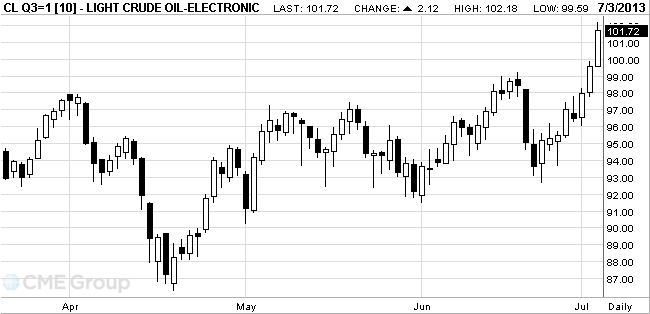

- Oil rose

Market news

Oil rose

Crude oil

surged, with West Texas Intermediate surpassing $100 a barrel for the first

time in nine months, as the government reported that

WTI climbed

as much as 2.6 percent. The Energy Information Administration said that

supplies fell 10.3 million barrels to 383.8 million. The report was projected

to show a 2.25 million-barrel decline, according to a survey. Prices

also rose after

WTI crude

for August delivery gained $1.97, or 2 percent, to $101.57 a barrel at 10:34

a.m. on the New York Mercantile Exchange. The contract traded at $101.45 before

the release of the EIA report at 10:30 a.m. in

There will

be no floor trading in the Nymex tomorrow because of the U.S. Independence Day

holiday. Any electronic trades will be booked for July 5.

Brent oil

for August settlement rose $1.47, or 1.4 percent, to $105.47 a barrel on the

London-based ICE Futures Europe exchange. The European benchmark grade was at a

$3.90 premium to WTI after falling to as little as $3.10 today. The spread was

$4.40 yesterday, the narrowest based on closing prices since Jan. 4, 2011. It

was more than $23 in February.