- Crude slips from 15-month high on jobless data

Market news

Crude slips from 15-month high on jobless data

West Texas

Intermediate slipped from a 15-month high as more Americans than expected filed

for unemployment benefits and the International Energy Agency predicted global

supply will outstrip demand growth next year.

Prices

dropped as much as 1.7 percent after the Labor Department said jobless claims

increased to a two-month high in the week ended July 6. First-time jobless

claims rose by 16,000 to 360,000 last week, the Labor Department said. The

median forecast of 47 economists called for a drop to 340,000. The four-week

moving average, a less volatile measure than the weekly figures, climbed to

351,750 last week from 345,750.

Oil

production in non-OPEC countries will expand at the fastest pace in 20 years in

2014, the IEA said. World oil consumption will climb by 1.2 million barrels a

day next year, the Paris-based IEA said in its first monthly report with

forecasts for 2014. Supplies from outside the Organization of Petroleum

Exporting Countries will jump by 1.3 million barrels a day amid booming output

in

Oil has

jumped more than 9 percent this month on concern that

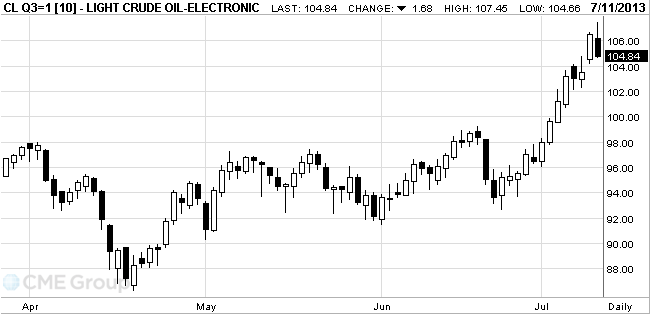

WTI for

August delivery declined $1.76, or 1.7 percent, to $104.76 a barrel at 11:07

a.m. on the New York Mercantile Exchange. It climbed to $107.45 a barrel

earlier, the highest intraday price since March 27, 2012. The volume of all WTI

futures traded was 63 percent above the 100-day average for the time of day.

Brent for

August settlement slid 87 cents, or 0.8 percent, to $107.64 a barrel on the

London-based ICE Futures Europe exchange. Volume was 14 percent above 100-day

average. WTI’s discount to Brent, the European benchmark, narrowed in intraday

trading to as little as $1.32 a barrel, the smallest gap since Nov. 15, 2010. The

retreat in WTI futures allowed the grade’s discount to North Sea Brent to widen

again.