- European session: the pound rose

Market news

European session: the pound rose

08:30 United Kingdom ILO Unemployment Rate May 7.8% 7.8% 7.8%

08:30 United Kingdom Average Earnings, 3m/y May +1.3% +1.4% +1.7%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May +0.9% +1.1% +1.0%

08:30 United Kingdom Bank of England Minutes

08:30 United Kingdom Claimant count June -8.6 -7.9 -21.2

08:30 United Kingdom Claimant Count Rate June 4.5% 4.5% 4.4%

09:00 Eurozone Construction Output, m/m May +2.0% -0.3%

09:00 Eurozone Construction Output, y/y May -6.6% -5.1%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 2.2 4.8

Euro traded moderately lower against the U.S. dollar in anticipation of speeches by Fed Chairman Ben Bernanke (Wednesday before the Committee on Financial Services of the House of Representatives and on the Thursday before the Senate Committee on Banking). Experts note that the probability that Bernanke will surprise the market is low - most likely the option of maintaining QE in the previous volumes will be confirmed, but such an alignment is already embedded in the dynamics of the EUR / USD and tangible drawdown dollar on the news seems to be unlikely.

The pressure on the single currency had data on production in the construction sector. In May, the volume of production in the construction sector of the euro area fell by 0.3% compared to growth of 2% a month earlier, as reported by the agency Eurostat. In the annual comparison figure fell by 5.1% against a decline of 6.6% in the previous month.

The British pound rose against the dollar after strong labor market data and the minutes of the last meeting of the Bank of England.

In June, the number of unemployed Britons fell by 21.2 million against 16.2 million the previous month, as reported by the national statistics agency. It was the strongest decline since June 2010. The number of applications for benefits totaled 1.48 million analysts expected a drop of 8 thousand unemployment rate fell to 4.4% from 4.5% previously, while analysts had expected the index to remain unchanged. The ILO unemployment rate in May remained at 7.8% in line with expectations. Average earnings excluding bonuses rose by 1% versus 0.9% previously forecast and 1.1%. Earnings including bonuses rose by 1.7% vs. 1.3% forecast of 1.4%.

All nine members of the monetary policy of the Bank of England in July voted to keep unchanged the existing program to stimulate the economy. At the same time, within the committee remained disagreement over the need for additional incentives. At the first meeting of the Committee on Monetary Policy, chaired by Mark Carney, all nine members of the committee decided not to change the program of buying government bonds. Such absolute unanimity was observed for the first time since October 2012. However, some committee members see the need to increase incentives. They want to understand what tools, in addition to asset purchases, it will be possible to apply under the direction of Carney to boost the economy.

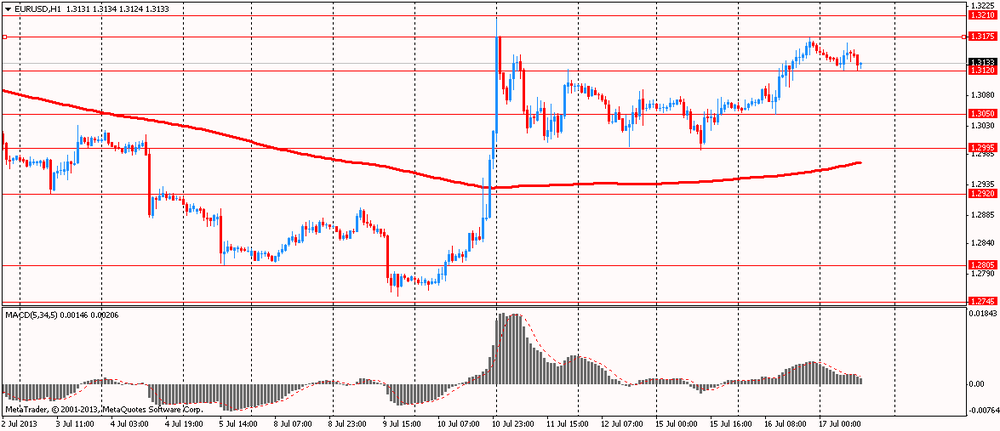

EUR / USD: during the European session, the pair is trading in the range of $ 1.3121 - $ 1.3166

GBP / USD: during the European session, the pair rose to $ 1.52455

USD / JPY: during the European session, the pair rose to Y99.83

At 12:30 GMT in Canada will the volume of transactions with foreign securities in May. U.S. at 12:30 GMT will publish the volume of building permits issued, the number of Housing Starts in June. At 14:00 GMT we will know the decision of the Bank of Canada Interest Rate and the accompanying statement will be made of the Bank of Canada. At 14:00 GMT the chairman of Board of Governors of the Federal Reserve Ben Bernanke testifies. At 14:30 GMT will be the publication of the report of the Bank of Canada's Monetary Policy for the 3rd quarter. At 15:15 GMT will be a press conference by the Bank of Canada. At 16:30 GMT a speech FOMC member Sarah Bloom Raskin. At 18:00 GMT the United States will publish economic survey of the Fed's regional "Beige Book."