- Oil fluctuated

Market news

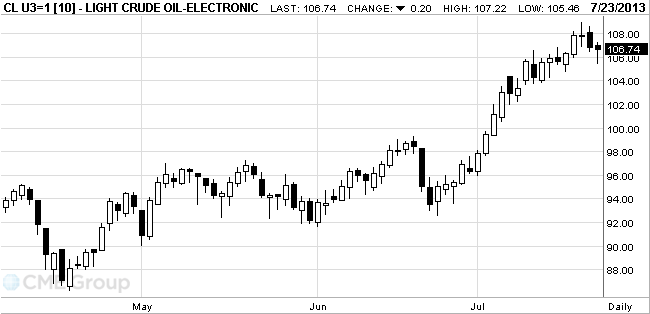

Oil fluctuated

West Texas

Intermediate crude fluctuated on speculation that the Federal Reserve will pare

stimulus in September and as

Futures

fluctuated as economists surveyed by Bloomberg predicted the Fed will trim

monthly bond buying to $65 billion from $85 billion. Premier Li Keqiang said

the slowest economic growth policy makers will tolerate is 7 percent, Beijing

News reported today. Goldman Sachs Group Inc. forecast WTI’s discount to Brent

will grow amid a U.S. Gulf Coast supply glut.

WTI for

September delivery dropped 1 cent to $106.93 a barrel at 10:51 a.m. on the New

York Mercantile Exchange. The volume of all futures traded was 18 percent above

the 100-day average for the time of day. Front-month futures settled at $108.05

on July 19, the highest level since March 19, 2012.

Brent for

September settlement gained 33 cents, or 0.3 percent, to $108.48 a barrel on

the London-based ICE Futures Europe exchange. Volume was 2.1 percent below

100-day average. The European benchmark’s premium to WTI widened to as much as

$2.73, from yesterday’s close of $1.21. WTI rose above Brent on July 19 for the

first time since 2010.