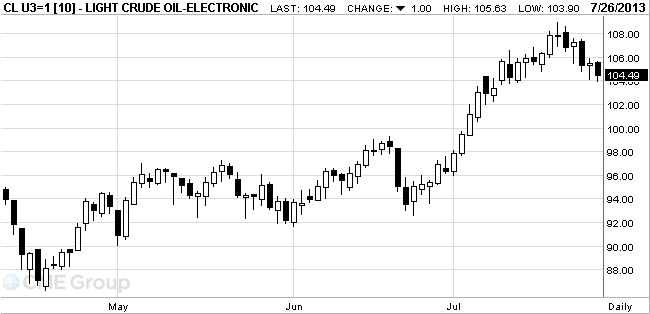

- Oil fell

Market news

Oil fell

West Texas

Intermediate crude fell, heading for the first weekly drop in more than a

month, on speculation that

Futures

slid as much as 1.5 percent after

WTI crude

for September delivery fell $1.49, or 1.4 percent, to $104 a barrel at

Brent for

September settlement dropped $1.05, or 1 percent, to $106.60 a barrel on the

London-based ICE Futures Europe exchange. The European benchmark traded at a

$2.60 premium to WTI, compared with $2.16 yesterday. Brent fell below WTI in

intraday trading July 19 for the first time since August 2010.