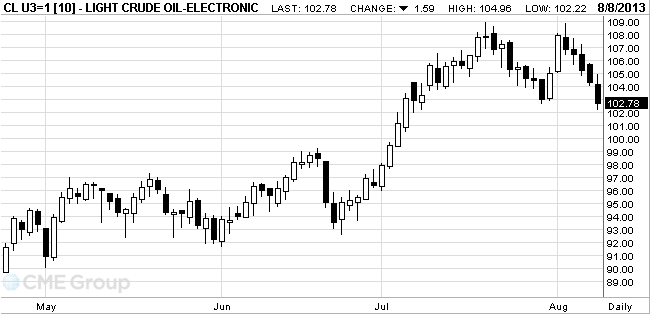

- Oil fell for a fifth day

Market news

Oil fell for a fifth day

West Texas

Intermediate crude fell for a fifth day, the longest stretch of declines since

December, as better-than-expected

Prices

dropped as much as 2 percent. About 333,000 American workers applied for

unemployment benefits last week, below the 335,000 estimate by economists in a survey.

The Fed may begin curbing bond purchases in September, Fed Bank of Chicago

President Charles Evans said Aug. 6.

WTI for

September delivery slid $1.89, or 1.8 percent, to $102.48 a barrel at 10:39

a.m. on the New York Mercantile Exchange. The volume of all futures traded was

6 percent above the 100-day average. Prices last slid for five consecutive days

in the period ended Dec. 10.

Brent for

September settlement slipped $1.36, or 1.3 percent, to $106.08 a barrel on the

London-based ICE Futures Europe exchange. Volume was 1 percent lower than the

100-day average.