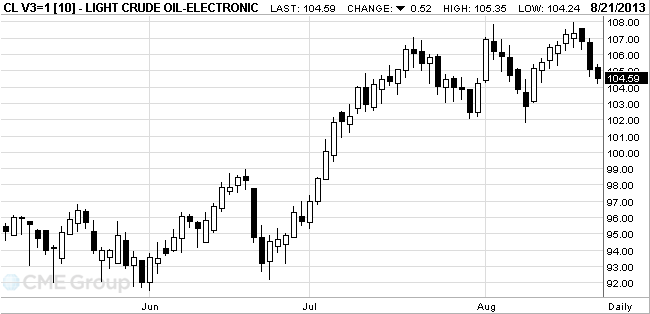

- Oil fell

Market news

Oil fell

West Texas

Intermediate crude dropped to the lowest level in more than a week amid

speculation that the Federal Reserve will reduce economic stimulus.

Futures

fell as much as 0.8 percent. The Federal Open Market Committee will publish

minutes of a July meeting today, with 65 percent of economists surveyed by

Bloomberg forecasting the Fed will taper bond purchases next month. A

WTI crude

for October delivery slid 26 cents, or 0.2 percent, to $104.85 a barrel at

10:48 a.m. on the New York Mercantile Exchange. The contract traded at $104.75

before the release of the report at 10:30 a.m. in

Brent for

October settlement dropped 5 cents to $110.10 a barrel on the London-based ICE

Futures Europe exchange. Trading of futures was 9.2 percent below the 100-day

average. The European benchmark crude traded at a $5.25 premium to WTI. The

spread was $5.04 at yesterday’s settlement, the widest since June 28.