- European session: risk currencies under pressure of the situation in Syria

Market news

European session: risk currencies under pressure of the situation in Syria

08:00 Germany IFO - Business Climate August 106.2 107.1 107.5

08:00 Germany IFO - Current Assessment August 110.1 111.0 112.0

08:00 Germany IFO - Expectations August 102.4 103.1 103.3

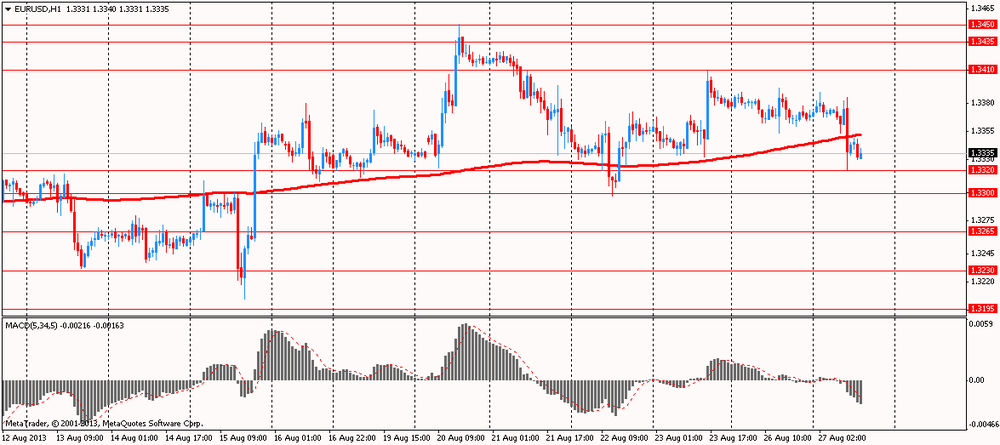

The euro rose against the dollar after the release of data from the German Ifo, which exceeded expectations. However, the EUR / USD fell immediately turned around and updating the session lows.

The mood in German business confidence strengthened in August amid improved prospects for exports, thus confirming that Europe's largest economy is gaining momentum after a weak start to the year. This was reported today institute Ifo. According to published data, the index of business sentiment in Germany Ifo in August rose for the fourth consecutive time: its value was 107.5 against 106.2 in July, while the projected increase to 107.1.

Previously was also published positive results of a survey of purchasing managers in Germany, according to which business activity grew at the fastest pace in seven months.

The index of business sentiment in the manufacturing sector increased significantly and reached its highest level since April 2012, as companies anticipate growth in exports.

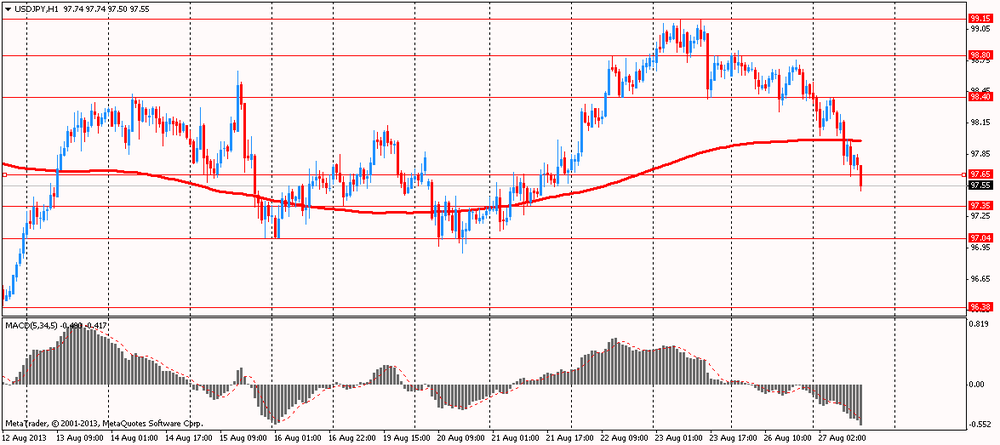

The yen rose against all major currencies against the falling value of the Asian and European shares, which increased demand for safe-haven assets. This decrease is due to the stock indices growing tensions in Syria. On Monday, U.S. Secretary of State, John Kerry said that the U.S. intelligence there is conclusive evidence that chemical weapons were used near Damascus Syrian government forces, and that should not go unpunished. According to him, President Barack Obama prepares to take a decision on this issue, as only in the Syrian army had missiles capable by chemical attack.

The dollar index is trading near three-week high, as many investors are of the view that the U.S. economy has recovered in order to the Federal Reserve began reducing monetary stimulus in September. Additional impact on the U.S. dollar exchange rate can have a release housing price index from the S & P / Case-Shiller. According to the median forecast of economists, the cost of housing in 20 large U.S. cities is likely to rise in June, up 12.1% against the same values in the previous month. Recall that the growth of 12.2% was the largest since March 2006.

EUR / USD: during the European session, the pair rose to $ 1.3386, and then fell to $ 1.3321

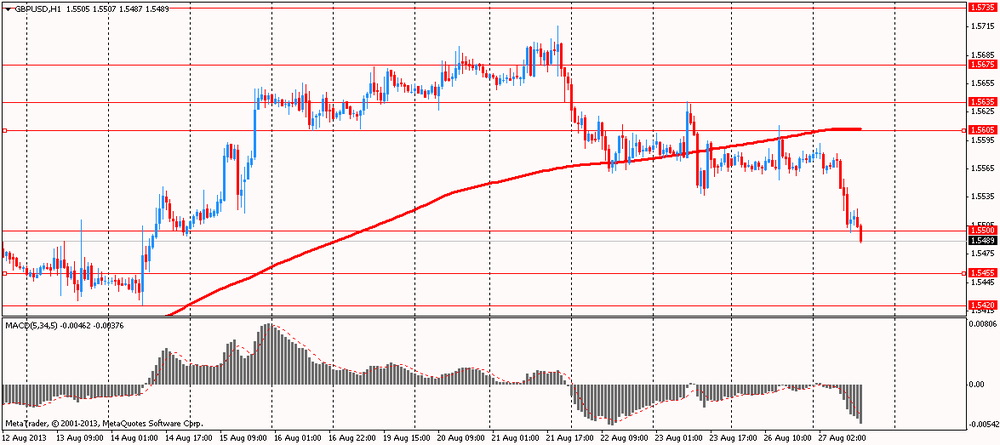

GBP / USD: during the European session, the pair fell to $ 1.5487

USD / JPY: during the European session, the pair fell to Y97.50

In the U.S. will be released at 13:00 GMT the index of housing prices in 20 major cities S & P / Case-Shiller, a national composite house price index S & P / CaseShiller for June, to 14:00 GMT - an indicator of consumer confidence for August.