- Oil rose

Market news

Oil rose

West Texas

Intermediate crude rose for a second day as Russian President Vladimir Putin

said his nation will assist

Prices

climbed as much as 1.8 percent. Putin said that

“Will we

help

Crude also

gained on speculation that the Federal Reserve will limit its stimulus

reduction following slower-than-expected jobs growth. Prices also climbed as

the Labor Department said non-farm payrolls grew 169,000 last month, less than

180,000 median forecast of 96 economists. The move followed a revised 104,000

rise in July that was smaller than the initial estimate of 162,000.

The

unemployment rate, derived from a survey of households rather than employers,

dropped to 7.3 percent, the lowest level since December 2008. The participation

rate, which indicates the share of working-age people in the labor force,

declined to 63.2 percent, the least since August 1978, from 63.4 percent.

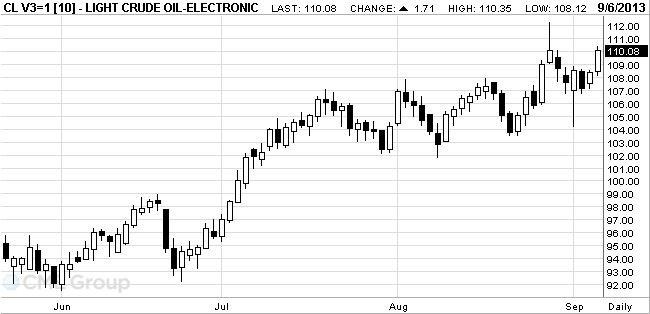

WTI for

October delivery gained $1.73, or 1.6 percent, to $110.10 a barrel at 11:16

a.m. on the New York Mercantile Exchange. Prices are up 2.3 percent this week.

Volume of all futures was 3.7 percent below 100-day average.

Brent for

October settlement rose 91 cents, or 0.8 percent, to $116.17 a barrel on the

ICE Futures Europe exchange. The volume of all futures traded was near the

100-day average.