- European session: the euro fell

Market news

European session: the euro fell

06:45 France CPI, m/m August -0.3% +0.5% +0.5%

06:45 France CPI, y/y August 0.0% +1.0%

08:00 Eurozone ECB Monthly Report September

09:00 Eurozone Industrial production, (MoM) July +0.7% -0.1% -1.5%

09:00 Eurozone Industrial Production (YoY) July +0.3% -0.1% -2.5%

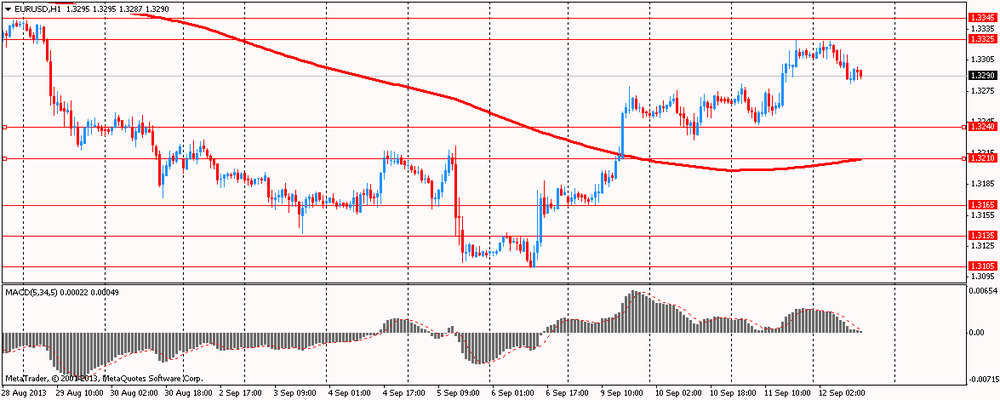

The euro fell against the dollar on weak data on industrial production in the euro area. Industrial production fell 1.5 percent in July compared with the previous month , graded the 0.6 percent rise in June , according to Eurostat . According to forecasts , industrial production was reduced by 0.1 percent . Intermediate goods fell by 0.7 percent, while the production of energy fell by 1.6 percent. Production of capital goods and durable consumer goods fell by 2.6 percent and 2.2 percent , respectively. The consumer non-durable goods fell 0.9 percent. On an annual basis, industrial production decline deepened to 2.1 percent from 0.4 percent in June. Figure exceeded the consensus forecast of a 0.1 percent drop .

Based on these data , the euro zone economy is unlikely to show strong performance in the III quarter. The downturn in the industry due to a significant drop in production at the German , Italian and French companies. Production in these countries is about two- thirds of the total. Industrial production in Germany fell by 2.3 percent. An even stronger decline was registered in the smaller countries such as Ireland, where production fell by 8.7 percent, and Malta, where the index fell by 6.7 percent.

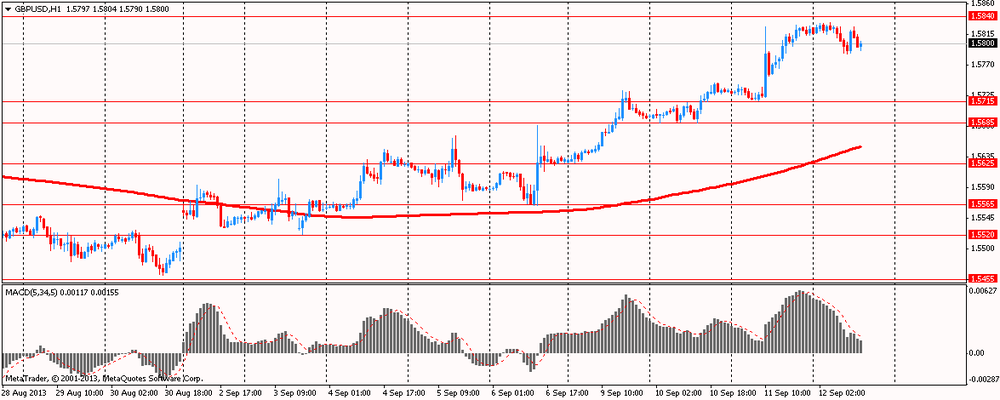

The pound rose to the comments of the head of the Bank of England and crossed the mark of $ 1.5800 , but later backed down and continued to decline. Carney statements were more aggressive than usual. The head of the Bank of England said that "the monetary authorities set the medium-term inflation target of 2.5 % instead of 2% due to the fact that 35 % of the unemployed are long-term unemployed ." "In order to increase transparency new MPC members must report whether they are guided by the current " politics of transparency. " Moreover, Carney said in Parliament that "the effectiveness of the policy of the Central Bank has increased, which can be called mitigation ." Fisher and Miles also noted that "the achievement of 2.5 % level of inflation will force the Bank to reconsider the policy ," and "the reaction of markets to improve the GDP may be temporary ."

Investors expect the output of the U.S. employment report . According to the median forecast of economists , the number of new applications for unemployment benefits last week , is likely to grow to 330 thousand , while the last reporting rate recorded growth of 323 thousand

EUR / USD: during the European session, the pair fell to $ 1.3282

GBP / USD: during the European session, the pair dropped to $ 1.5785

USD / JPY: during the European session, the pair fell to Y99.18

At 12:30 Canada is to publish an index of housing prices in the primary market in July. At 12:30 GMT the United States will number of initial claims for unemployment insurance , the number of continuing claims for unemployment benefits , the import price index for August. At 17:00 the U.S. spends 30-year bonds. At 18:00 GMT the United States will present the monthly performance report for August. At 22:30 GMT New Zealand will release the index of business activity in the manufacturing sector of Business NZ in August.