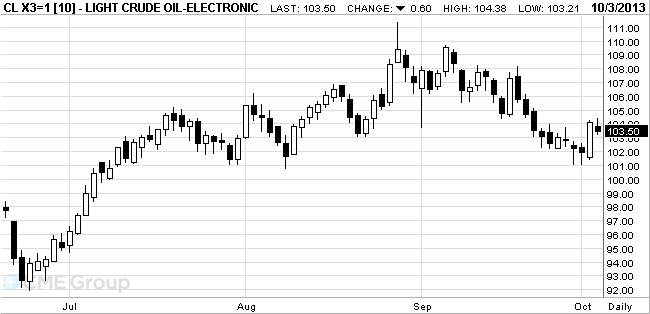

- Oil fell

Market news

Oil fell

West Texas

Intermediate fell from its highest settlement in almost two weeks as the

Futures

slid as much as 0.6 percent in

WTI for

November delivery dropped as much as 65 cents to $103.45 a barrel in electronic

trading on the New York Mercantile Exchange. It was at $103.69 as of 1:22 p.m.

Brent for

November settlement fell as much as 49 cents, or 0.5 percent, to $108.70 a

barrel on the London-based ICE Futures Europe exchange. The European benchmark

was at a premium of $5.82 to WTI, up from $5.09 yesterday, the least since

Sept. 23.