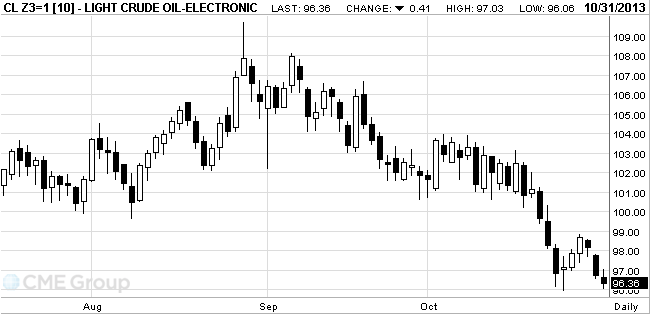

- Oil fell

Market news

Oil fell

West Texas

Intermediate fell for a third day as

Prices slid

as much as 0.7 percent. Inventories rose by 4.09 million barrels to 383.9

million last week, the highest level since June, the Energy Information

Administration said yesterday. The euro declined the most since June versus the

dollar as inflation in the euro region unexpectedly dropped. WTI’s discount to

Brent shrank from the widest in seven months.

WTI for

December delivery slid 50 cents, or 0.5 percent, to $96.27 a barrel at 10:43

a.m. on the New York Mercantile Exchange. It settled at a four-month low of

$96.77 yesterday. The volume of all futures traded was 9.5 percent below the

100-day average. Prices have retreated 5.9 percent in October.

Brent for December settlement dropped 91 cents, or 0.8 percent, to $108.95 a barrel on the London-based ICE Futures Europe exchange. Volume was 4.4 percent above the 100-day average. The European benchmark’s premium to WTI was $12.68. Earlier, it touched $13.58, the most since April.