- Asian session: The euro rose against the dollar

Market news

Asian session: The euro rose against the dollar

00:30 Australia Trade Balance September -0.82 -0.51 -0.28

The euro rose against the dollar and the yen as traders speculated a recent drop in the common currency was too rapid with economists saying the European Central Bank will hold interest rates unchanged tomorrow.

The yen fell against major peers as a surge in Asian equities reduced demand for the currency as a haven.

The dollar retreated from near a six-week high against the euro before data tomorrow forecast to show the world’s largest economy slowed last quarter, weighing on expectations the Federal Reserve will move to reduce stimulus. A report tomorrow is predicted to show U.S. gross domestic product grew at a 2 percent annualized rate in the third quarter, down from 2.5 percent in the previous three months, according to the median estimate in a Bloomberg News survey. San Francisco Fed President John Williams said yesterday economic growth in recent months has fallen short of his expectations, partially eroding his confidence gains in the labor market will endure without monetary stimulus.

New Zealand’s kiwi climbed to its highest since Oct. 24 as employers added more jobs than forecast. The nation’s employment rose 1.2 percent in the third quarter, compared with a 0.4 percent gain in the previous three months.

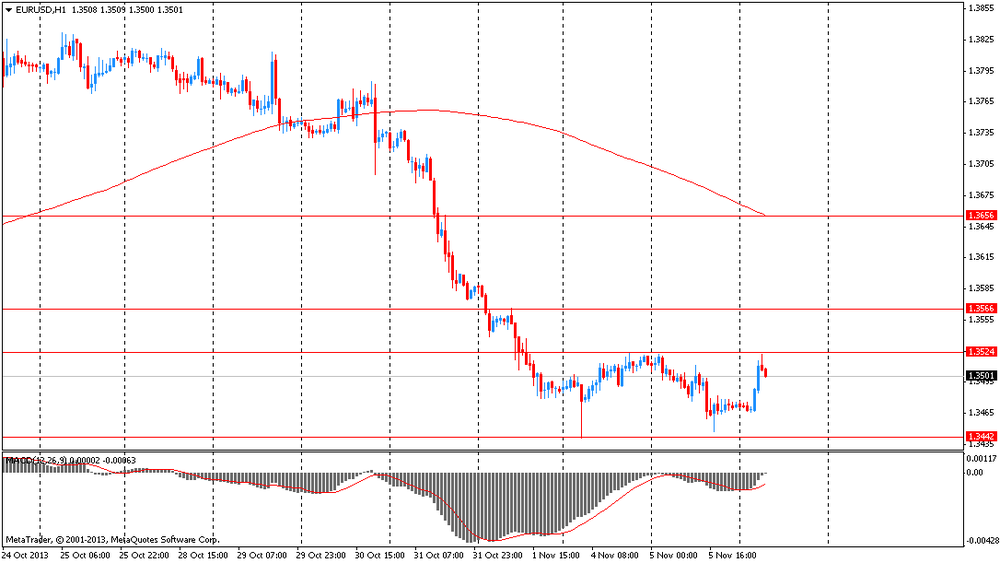

EUR / USD: during the Asian session the pair rose to $ 1.3525

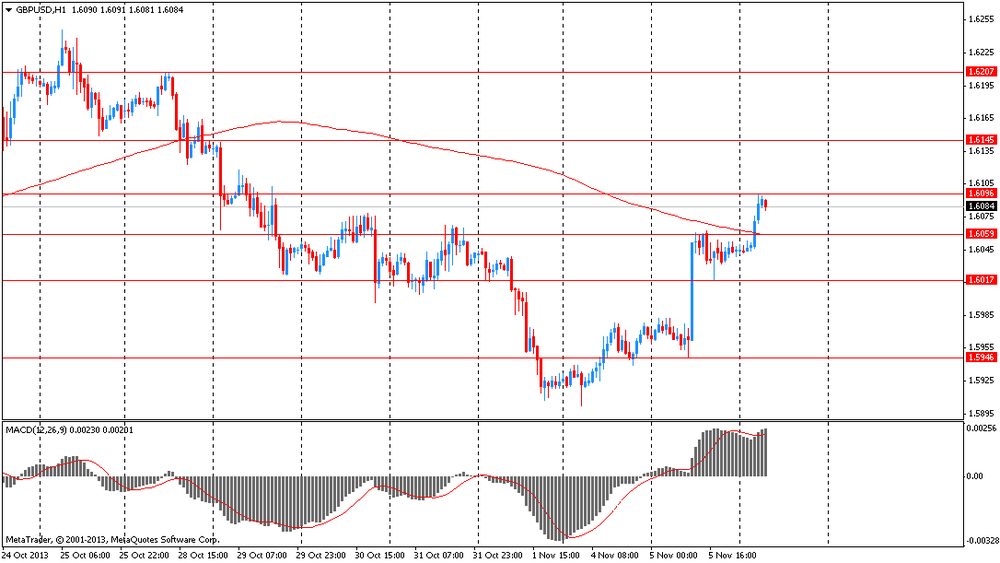

GBP / USD: during the Asian session, the pair rose to $ 1.9095

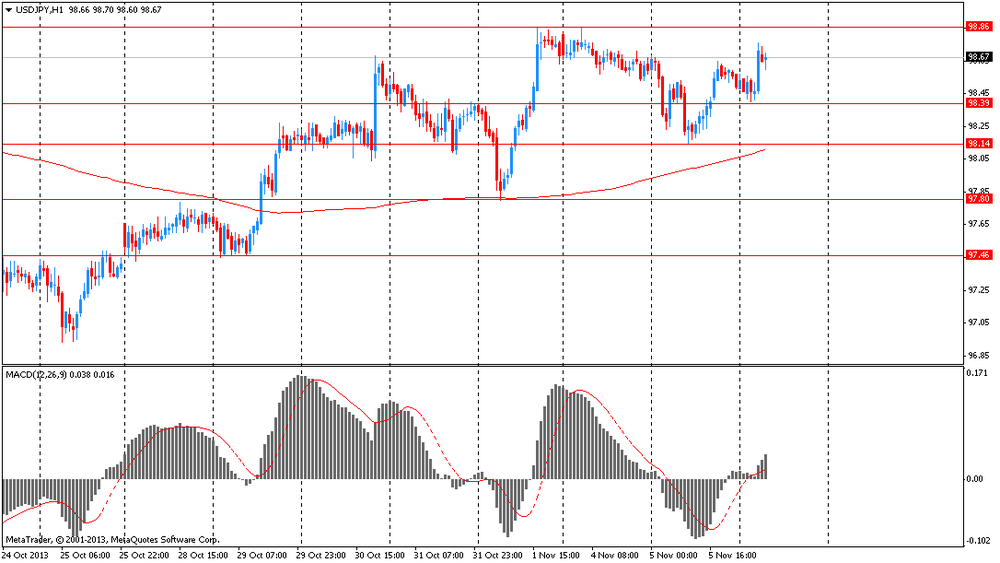

USD / JPY: during the Asian session the pair rose to Y98.75

Across the Atlantic, the calendar gets underway from 1200GMT, when the MBA Mortgage Index for the November 1 week are released, followed by the October challenger layoffs data at 1230GMT. At 1500GMT, the US September Leading Indicator data will be released. The index of leading indicators is expected to rise 0.7% in September. Positive contributions are expected from a lower initial claims level and some rebound in stock prices, offset by a decline in consumer expectations and a shorter factory workweek. At 1530GMT, the EIA Crude Oil Stocks for the November 1 week are due to be released. At 1810GMT, Cleveland Federal Reserve Bank President Sandra Pianalto will deliver a speech on housing and the economy, in Columbus, Ohio.