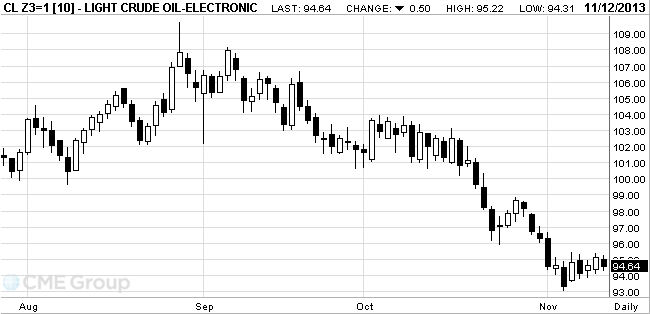

- Oil fell

Market news

Oil fell

West Texas

Intermediate fell for the first time in three days amid forecasts that U.S.

crude inventories rose to the most since June.

Prices

dropped as much as 0.9 percent as stockpiles in the world’s biggest

oil-consuming country climbed for an eighth week. Inventories added 650,000

barrels through Nov. 8, according to a Bloomberg survey before an Energy

Information Administration report on Nov. 14. The U.S. will become the largest

oil producer by 2015, the International Energy Agency said today. Gasoline

prices advanced for a third day.

WTI for

December delivery dropped 60 cents, or 0.6 percent, to $94.54 a barrel at 11:08

a.m. on the New York Mercantile Exchange. It advanced to $95.14 yesterday, the

highest settlement since Oct. 31. The volume of all futures traded was 12

percent below the 100-day average.

Brent for

December settlement rose 30 cents, or 0.3 percent, to $106.70 a barrel on the

London-based ICE Futures Europe exchange. The volume was 18 percent above the

100-day average. The European benchmark crude’s premium over WTI widened to

$12.16 from $11.26 yesterday.