- European session: the euro fluctuated

Market news

European session: the euro fluctuated

06:45 Switzerland SECO Economic Forecasts Quarter I

07:00 Switzerland Trade Balance November 2.43 2.57 2.11

09:00 Eurozone Current account, adjusted, bln October 13.7 14.2 21.8

09:30 United Kingdom Retail Sales (MoM) November -0.9% Revised From -0.7% +0.3% +0.3%

09:30 United Kingdom Retail Sales (YoY) November +1.8% +2.2% +2.0%

The euro is trading sideways against the U.S. dollar, after adjusting dollar growth caused by yesterday's decision to cut the Fed asset purchases by $ 10 billion to $ 75 billion a month , and an increase in the economic outlook for the United States . So , after a meeting of 17-18 December the Fed has reduced its quantitative easing program and kept the target range of the base interest rate of zero to 0.25 % per annum. Fed from January 2014 intends to reduce purchases of government bonds to $ 45 billion to $ 40 billion a month , mortgage-backed securities - from $ 40 billion to $ 35 billion a month . At the same time the Fed is ready to continue the reduction of future meetings , if justified its macroeconomic forecasts . The Federal Open Market Committee, stressed that the base rate will remain in the current range for a long time after the decline in the unemployment rate to less than 6.5% , especially in the case of continued low inflation . The Fed also improved assessment of the U.S. economy, noting that it justifies the move to curtail QE, and raised its forecast for next year.

The euro rose slightly after the release of data on the balance of payments in the eurozone. Eurozone current account surplus rose to a seasonally adjusted 21.8 billion euros in October from 14.9 billion euros in September. The surplus on goods, services and income increased in October , while the deficit in current transfers declined from September .

The surplus on trade in goods rose to 17 billion euros from 13.7 billion euros in September. In turn, the surplus on services increased to 9.4 billion euros from 8.8 billion euros. In addition, profit rose to 4.7 billion euros from 2.6 billion euros. At the same time , current transfers showed a deficit of 9.4 billion euros, compared with a deficit of 10.2 billion euros a month ago.

On an unadjusted basis the current account surplus widened to 26.2 billion euros in October from 15.2 billion euros in September.

Pound also traded in a range against the U.S. currency on background data on retail sales in Britain. Sales , including automotive fuel rose 0.3 percent on a monthly measurement in November , recovering from a revised 0.9 percent drop in October. The result was in line with economists' expectations .

Excluding automotive fuel , sales increased by 0.4 percent on a monthly measurement in November. It was a little faster than the expected increase of 0.3 percent. In October, retail sales fell by a revised 0.7 percent.

In annualized retail sales including automotive fuel , increased by 2 percent in November compared to expectations of 2.2 percent growth . Excluding fuel , sales increased by 2.3 per cent per annum, which is slower than the increase of 2.4 percent , which was expected .

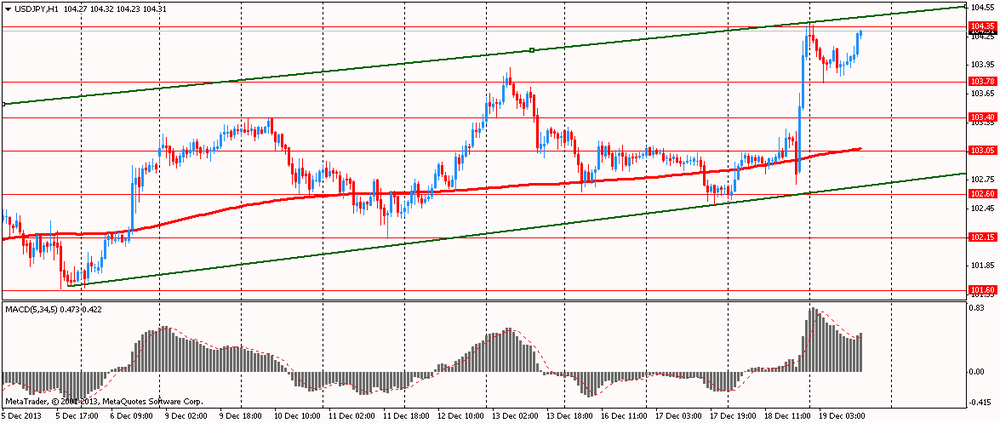

The yen lost some positions recruited against the dollar today after the beginning of the two-day meeting of the Bank of Japan. According to the median forecast of economists on the basis of a two-day meeting, which ends on December 20 , the Bank of Japan decides to keep the volume to stimulate the economy of the country at the same level . However, they expect quantitative easing program in Japan in 2014.

EUR / USD: during the European session, the pair rose to $ 1.3691 and retreated

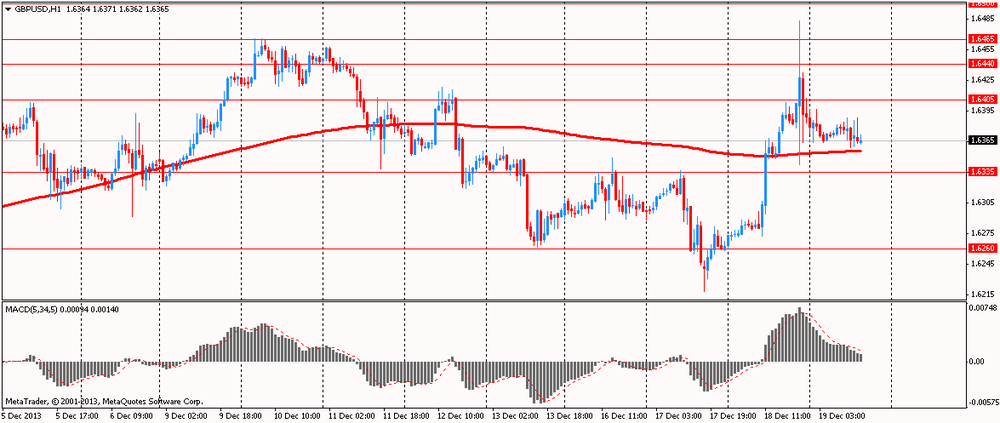

GBP / USD: during the European session, the pair traded in a narrow range of $ 1.6359 - $ 1.6388

USD / JPY: during the European session, the pair rose to Y104.31

U.S. at 13:30 GMT publish number of initial claims for unemployment insurance , the number of repeated applications for unemployment benefits in the 15:00 GMT - Sales in the secondary housing market in November , the Fed's manufacturing index for December - Philadelphia .