- Oil fell

Market news

Oil fell

West Texas Intermediate crude tumbled to the lowest level in more than six weeks, erasing an earlier advance of 0.7 percent.

Pressure on

oil futures continue to provide data to the government report , pointed out the

restrained demand for petroleum products .

According

to data released on Wednesday the U.S. Department of Energy , the oil reserves

in the country last week fell by 2.7 million barrels, while they expected a

decline of 600,000 barrels. Reducing oil reserves observed the sixth

consecutive week . However , news about the growth of stocks of petroleum

products have overshadowed reports of the high demand for oil .

According

to the Ministry of Energy , gasoline inventories in the week December 27 -

January 3, increased by 6.2 million barrels, while expected to rise by 2

million barrels. Distillate stocks , which include diesel and heating oil, rose

by 5.8 million barrels, while the projected growth of 1.5 million barrels .

Futures on

crude oil prices continued to decline after the December meeting of the

protocols of the Federal Reserve , according to which most of the leaders of

the central bank supported the folding of bond-buying program . The program

supported oil prices, weakening the dollar, which , in turn, makes oil more

attractive to foreign investors.

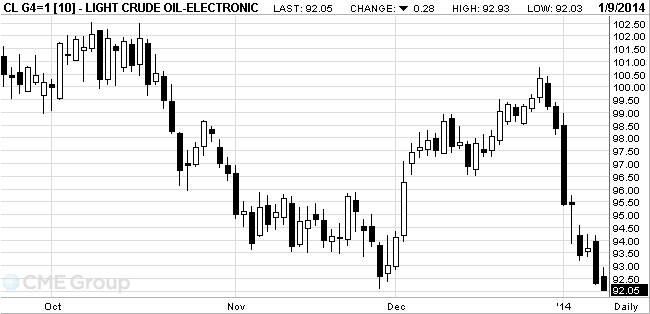

WTI for

February delivery slid 32 cents, or 0.3 percent, to $92.01 a barrel at 10:12

a.m. on the New York Mercantile Exchange. Earlier, it touched $91.94, the

lowest intraday price since Nov. 27. The volume of all futures traded was 8.9

percent below the 100-day average. Prices have fallen 5.9 percent since the

start of the year.

Brent for

February settlement increased 1 cent to $107.16 a barrel on the London-based

ICE Futures Europe exchange. The European benchmark crude was at a premium of

$15.15 to WTI, compared with $14.82 at yesterday’s close.