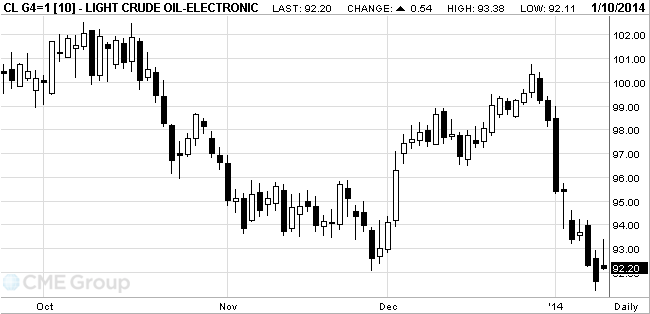

- Oil rose

Market news

Oil rose

West Texas

Intermediate rose from an eight-month low as a worse-than-expected jobs report

reduced concern that the Federal Reserve will further pare bond-buying.

Futures

gained as much as 1.9 percent, trimming a second weekly decline. Payrolls

increased in December at the slowest pace since January 2011 and the

unemployment rate dropped as more people left the labor force. Prices also

gained as

WTI for

February delivery climbed 66 cents, or 0.7 percent, to $92.32 a barrel at 10:46

a.m. on the New York Mercantile Exchange. The volume of all futures traded was

39 percent above the 100-day average. Prices are down 1.7 percent this week.

Brent for

February settlement slipped 8 cents to $106.31 a barrel on the London-based ICE

Futures Europe exchange. Volume was 12 percent above the 100-day average. The

European benchmark was at a premium of $13.99 to WTI, compared with $14.73

yesterday.