- European session: the euro fell moderately

Market news

European session: the euro fell moderately

The euro is trading with a moderate decrease against the U.S. dollar Friday after adjusting for growth of employment data . Investors assess the prospects for further minimize incentives in the U.S. before the performances of a number of heads of the Federal Reserve this week. So , on Monday would be the head of the Federal Reserve Bank ( FRB ) of Atlanta Dennis Lockhart , Tuesday - Charles Plosser of the Philadelphia Fed and Richard Fisher of the Dallas Fed - both in 2014 are entitled to vote on matters of monetary policy on the Committee on the Fed's operations on the open market . And on Thursday deliver a report the U.S. central bank chairman Ben Bernanke , his speech will be devoted to the general difficulties of central banks , and it is not clear whether it will affect the folding theme incentives. The next Fed meeting will be held January 28-29 .

Recall that the U.S. dollar declined against most major currencies on Friday after the U.S. in December, was created only 74,000 jobs , that is, was recorded the weakest growth since early 2011 . The unemployment rate , meanwhile, fell to 6.7 % compared with 7.0% in the previous month - the lowest level since October 2008 . But the decline seemed to occur mainly because more people left the work force. Economists had expected an increase of jobs in non-agricultural area at 193,000 while maintaining unemployment at 7.0 % in December.

The Australian dollar reached a one-month high against the dollar after the volume of mortgage lending in Australia increased in November. Total number of mortgages in Australia rose a seasonally adjusted 1.1 percent in November compared with the previous month, the Australian Bureau of Statistics reported on Monday, and was 52 912.

The main indicator coincided with economists' forecasts , after rising 1.0 percent in October.

Total number of loans for the construction of new homes rose by 2.3 percent to 5686 .

Credits for the purchase of new homes fell 4.3 percent to 2856, while loans to purchase housing on the secondary market rose by 1.4 percent to 44,370 .

The volume of loans rose to 1.7 percent , remaining unchanged from the previous month and totaled 26.934 billion Australian dollars .

Investment lending rose by 1.5 percent for the month and amounted to 10.383 billion Australian dollars , slowing from growth of 8.5 percent in October.

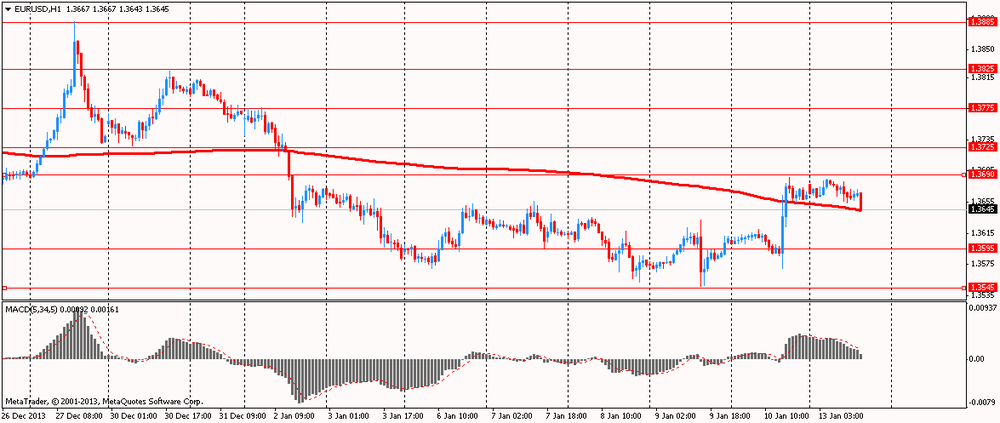

EUR / USD: during the European session, the pair fell to $ 1.3643

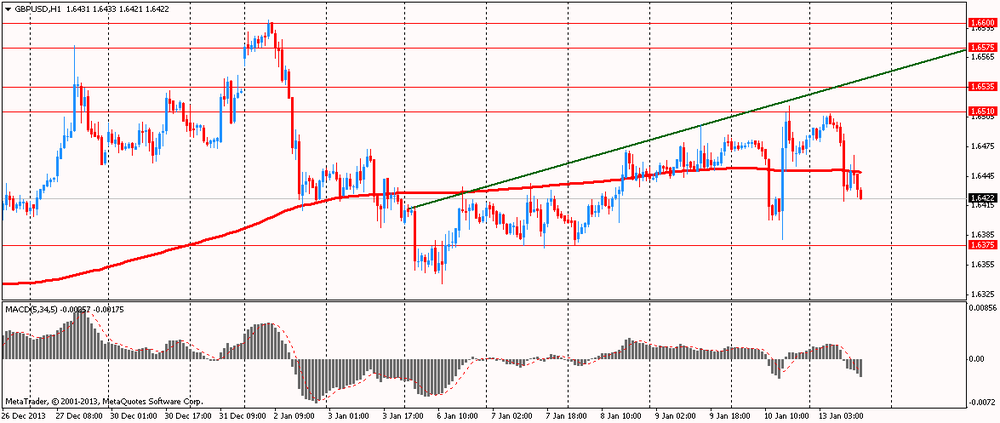

GBP / USD: during the European session, the pair fell to $ 1.6420

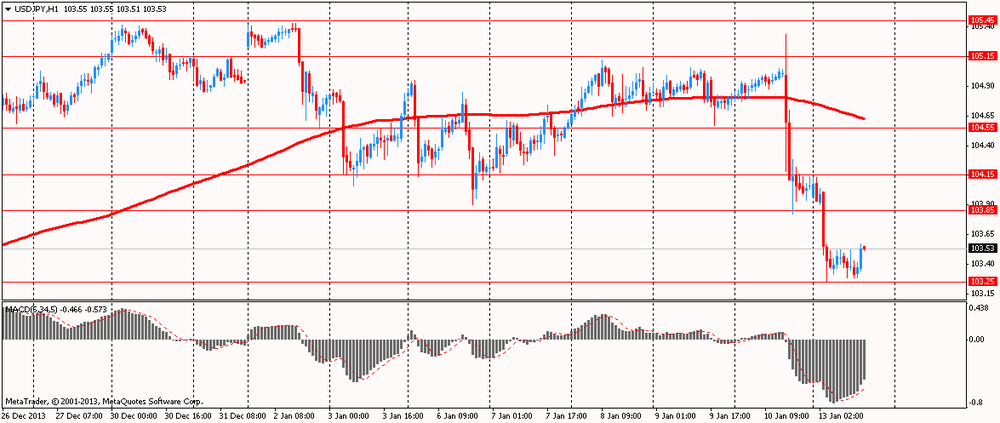

USD / JPY: during the European session, the pair rose to Y103.57

At 15:30 GMT , Canada will release indicator of expectations in the field of credit and financial institutions , according to the Bank of Canada , the light of the expected growth of trade (Review sentiment in the business environment of the Bank of Canada ) for the 4th quarter . At 19:00 GMT the United States will be released monthly budget execution report for December. At 21:00 GMT New Zealand is to publish house price index from REINZ, changing housing sales from REINZ for December sentiment indicator from the NZIER business environment for the 4th quarter . At 23:50 GMT , Japan will release the overall current account balance , total adjusted current account surplus in November.