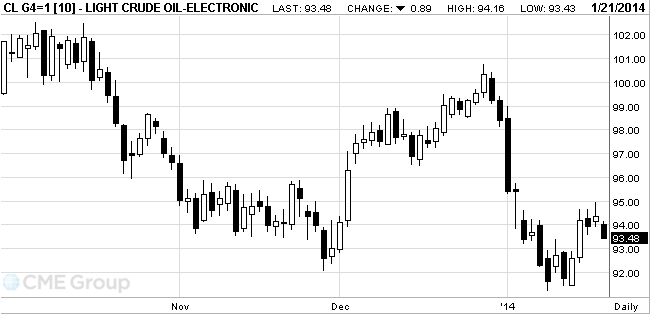

- Oil fell

Market news

Oil fell

West Texas

Intermediate slid from the highest closing price in two weeks amid slowing

economic growth and weaker industrial output in

Futures

lost as much as 0.9 percent in

WTI for

February delivery fell as much as 81 cents to $93.56 a barrel in electronic

trading on the New York Mercantile Exchange and was at $93.90 as of 9:42 a.m.

local time. The contract, which expires tomorrow, climbed 41 cents to $94.37 on

Jan. 17, the highest close since Jan. 2. The more-active March future was down

41 cents at $94.18. Floor trading is closed for a

Brent for

March settlement dropped as much as 38 cents to $106.10 a barrel on the

London-based ICE Futures Europe exchange. The volume of all contracts traded

was about 40 percent below the 100-day average. The European benchmark crude

was at a $12.25 premium to WTI for the same month.