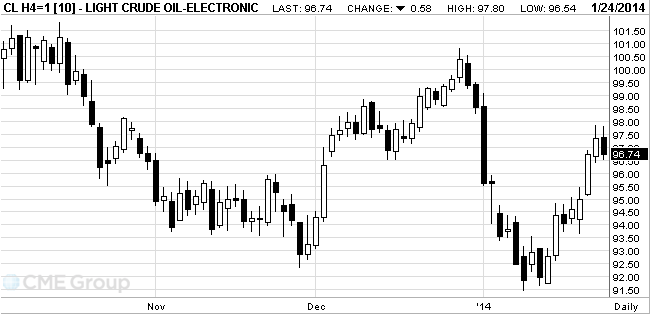

- Oil fell

Market news

Oil fell

West Texas

Intermediate crude narrowed its discount to Brent to the least in more than two

months after a pipeline carrying oil out of

The spread

between WTI and Brent shrank to $9.49, the smallest gap since Nov. 8. The

southern leg of the Keystone XL pipeline is initially transporting 288,000

barrels of light, sweet crude a day from the hub to

WTI for

March delivery fell 36 cents, or 0.4 percent, to $96.96 a barrel at 10:26 a.m.

on the New York Mercantile Exchange. It settled at $97.32 yesterday, the

highest close this year. The volume of all contracts traded was 2.8 percent

below the 100-day average. Prices are up 2.7 percent this week.

Brent for March settlement fell 79 cents, or 0.7 percent, to $106.79 a barrel on the ICE exchange. Volume was 9.5 percent above the 100-day average. The grade has advanced 0.3 percent this week. Brent’s premium to WTI was at $9.83 a barrel.