- European session: the euro fell

Market news

European session: the euro fell

08:15 Switzerland Consumer Price Index (MoM) January -0.2% -0.2% -0.3%

08:15 Switzerland Consumer Price Index (YoY) January +0.1% +0.1% +0.1%

10:00 Eurozone Industrial production, (MoM) December +1.6% Revised From +1.8% -0.2% -0.7%

10:00 Eurozone Industrial Production (YoY) December +2.8% Revised From +3.0% +1.8% +0.5%

10:30 United Kingdom Bank of England Quarterly Inflation Report Quarter I

10:30 United Kingdom BOE Gov Mark Carney Speaks

Тhe euro fell sharply against major currencies on the comments of the ECB representative Coeur introducing negative rates. ECB Coeur , said today that the Central Bank is "very seriously" considering the introduction of negative rates. His comments collapses the euro, which has lost more than 50 pips . against the dollar in a matter of minutes .

Previously, the pressure on the single currency had a report on industrial production in the eurozone. As shown by recent data on Wednesday statistical office Eurostat, industrial production in the euro area grew considerably slower pace in December , the growth rate fell short of economists' expectations .

Industrial production growth fell to 0.5 percent in December from a revised down 2.8 percent in the previous month . Economists forecast that growth will weaken to 1.8 percent from November 3 percent initially announced .

Production of energy fell by 1.9 percent compared to December 2012 . Consumer non-durable goods and durable consumer goods fell by 0.9 percent and 1.2 percent respectively. Meanwhile, the production of intermediate goods increased by 3.6 percent .

Among the EU Member States the largest increase was registered in Portugal , Romania , the Czech Republic and Slovenia. The largest decrease was recorded in Malta, Ireland, Estonia and Finland.

On a monthly measurement of industrial production fell by 0.7 percent in late 2013 , after a gain of 1.6 percent in November , which was revised downward from 1.8 percent . Production is projected should have been reduced by 0.2 percent.

The British pound appreciated sharply against the U.S. dollar on a background of the quarterly report of the Bank of England and the speech of the Central Bank of Carney . According to the Bank of England inflation report , published today , the Central Bank is going to keep rates at a record - low of 0.5 % , at least for another year, even if the unemployment rate / p fall to 7% threshold that, according to expectations occur in Q1 2014 . Bank of England pointed out that the British economy will grow even before the Bank to raise rates . But it is worth noting that the increase will be gradual and not to such a high level , which was celebrated before the crisis.

"The consequences of the financial crisis and the availability of economic obstacles indicate that some time rates should be kept at a low level , - the report says . - Even when the economy returns to a normal level of production capacity , and inflation closer to the target level , the bank rate will be significantly lower than 5 % ( level set before the crisis ) . "

MPC predicts that in the last quarter of 2013 Britain's GDP to grow by 0.9 % against the previous estimate of 0.7 %. As for the remainder of 2014 , the Central Bank expects to rise by 3.4 % versus 2.8 % November forecast .

As for inflation , according to expectations, in the 2nd quarter of 2015 its growth will slow to 1.7% , and then accelerate again in 2016 and will reach 1.9%.

Bank of England Governor Mark Carney , speaking at a press conference after the release of the report , noted that Britain's economic recovery is underway, but it "still is neither stable nor balanced ." He defended the policy of transparency , noting that it has helped reduce the rate hike expectations .

Carney also commented on the rapid drop in rates b / d to reach 7% , explaining the reduction of the total number of those citizens who do not have full employment. At the same time , he pointed out that the number of citizens with underemployment rose to historic highs .

Thus, under the policy of transparency , the Bank of England will consider a number of indicators , such as an index of manufacturing activity , working hours , labor productivity and wages . Size asset purchase program will continue to be £ 375 billion , at least until the first rate increase.

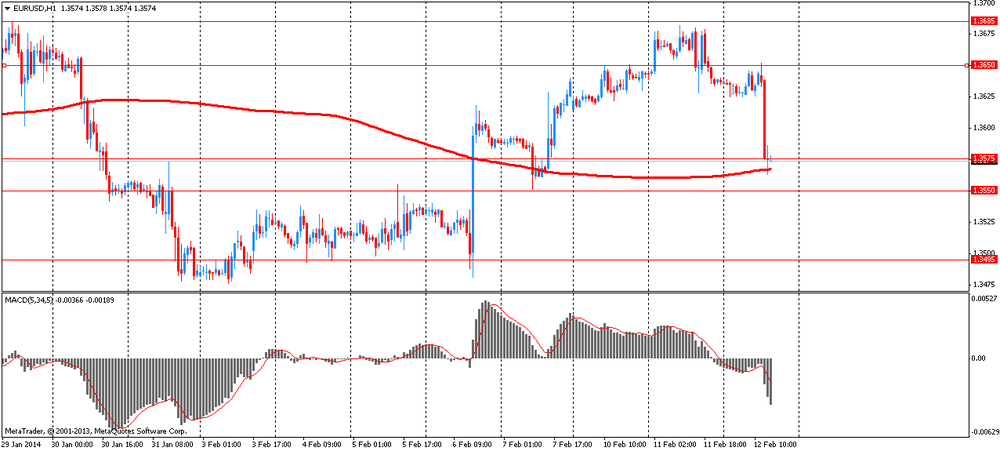

EUR / USD: during the European session, the pair fell to $ 1.3563

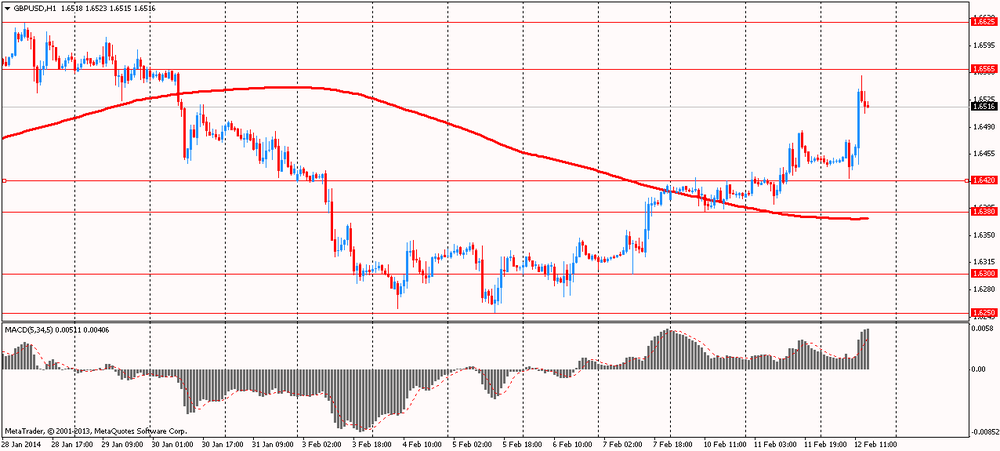

GBP / USD: during the European session, the pair rose to $ 1.6556

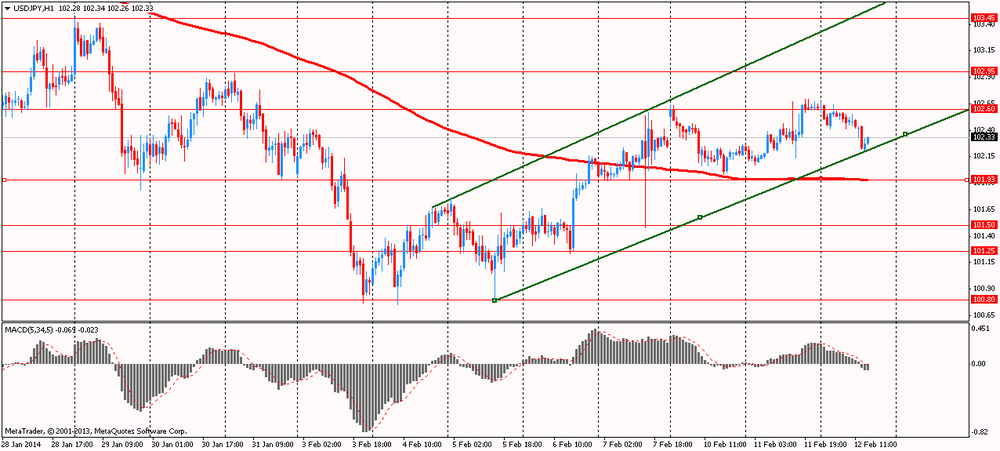

USD / JPY: during the European session, the pair dropped to Y102.21

At 18:00 GMT the U.S. is deploying 10 - year bonds . At 19:00 GMT the United States will submit a monthly report on the budget . At 21:30 GMT New Zealand will release the index of business activity in the manufacturing sector of Business NZ in January .