- Oil rose

Market news

Oil rose

West Texas

Intermediate crude rose to the highest level in four months on speculation that

inventories in

Prices

climbed as much as 1.3 percent. Supplies at Cushing, the delivery point for WTI

futures, probably dropped for a third week, according to analysts surveyed by

Bloomberg. A second storm in three days has brought more snow to the U.S.

Northeast and mid-Atlantic, bolstering the use of distillate fuels, including

heating oil and diesel.

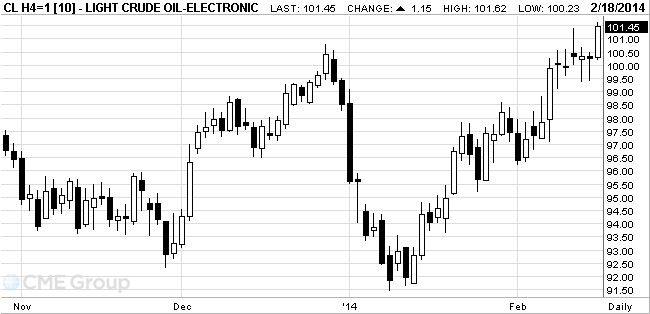

WTI for

March delivery increased $1.04, or 1 percent, to $101.34 a barrel at 10:39 a.m.

on the New York Mercantile Exchange. Prices touched $101.62 a barrel, the

highest level since Oct. 18. They have rallied 3.9 percent this month. The

volume of all futures traded was 35 percent above the 100-day average. Floor

trading was closed yesterday for the

Brent for

April settlement rose 41 cents, or 0.4 percent, to $109.59 a barrel on the

London-based ICE Futures Europe exchange. Volume was 44 percent below the

100-day average. The European benchmark grade was at a premium of $8.52 to WTI

for the same month. The spread was $8.95 on Feb. 14, the widest in a week based

on closing prices.