- Oil prices fluctuate

Market news

Oil prices fluctuate

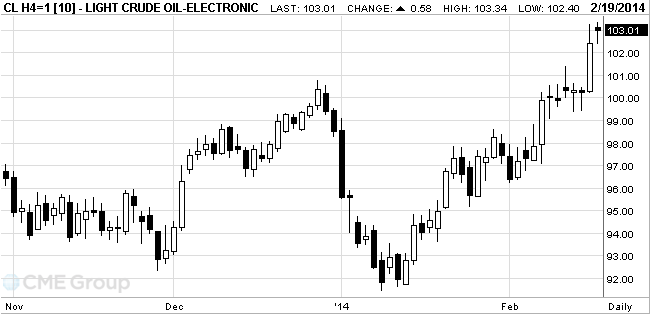

The cost of WTI crude oil is kept at close to $ 103 level on the background of continuing severe weather conditions in the United States .

Extremely cold weather in the U.S. boosts demand for heating oil , which in turn increases the price of WTI, which serves as a raw material.

Extreme cold, observed in most of the U.S. this winter, led to a sharp rise in demand and prices for fuels such as natural gas or fuel oil. Stocks of distillates , including heating oil , are 22% below average levels for this time of year . Published on Tuesday revised forecasts indicate that next week in the United States resumed heavy frosts , whereas previously predicted steady warming.

Later investors awaited the publication of a number of important market data from the U.S. and China. So , later on Wednesday the American Petroleum Institute will present data on the dynamics of the weekly wholesale inventories of raw materials in the United States . Distillate stocks in the country is forecast down 1.8 million barrels .

Analysts also believe that oil stocks at Cushing ( the largest terminal in the U.S.) for the week ended February 20 fell by 1.4 million barrels .

In addition, the dynamics of trade can affect publication of the minutes of the last meeting of the U.S. Federal Reserve , as well as data on the index of business activity in the manufacturing sector in China , calculated by the bank HSBC, in February.

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) traded in the range $ 102.40 - $ 103.34 per barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture rose 21 cents to $ 110.67 a barrel on the London exchange ICE Futures Europe.