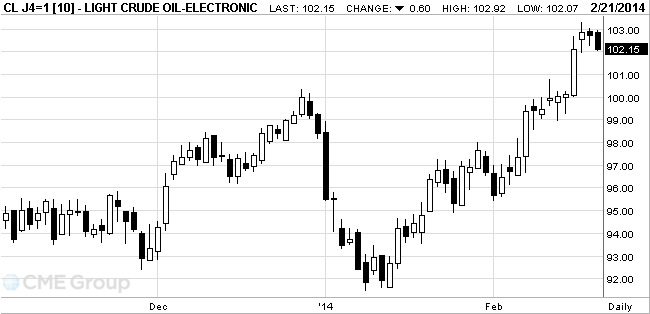

- Oil fell

Market news

Oil fell

West Texas

Intermediate crude declined on the New York Mercantile Exchange, paring a sixth

consecutive weekly gain. Brent also slipped, narrowing a gain for the week.

WTI for

April delivery dropped 56 cents, or 0.5 percent, to $102.19 a barrel at 10:50

a.m. on the New York Mercantile Exchange. The volume of all futures traded was

27 percent below the 100-day average. Crude is up 1.9 percent this week and 10

percent in the past six weeks.

Brent for

April settlement slipped 48 cents, or 0.4 percent, to $109.82 on the

London-based ICE Futures Europe exchange. Prices are up 0.7 percent this week.

Trading was 37 percent lower than the 100-day average. The European benchmark crude

was traded at $7.63 premium to WTI, little changed from $7.55 yesterday.

WTI is set

for the longest run of weekly gains in a year with supplies falling at Cushing

and cold weather bolstering fuel demand. The opening of the Keystone XL

pipeline’s southern link in January eased a bottleneck in the central

WTI may

fall next week as stockpiles expand, a Bloomberg survey shows. Twenty-three of

28 analysts and traders, or 82 percent, said futures will decrease through Feb.

28. Four respondents expected prices to gain while one forecast there will be

little change.