- European session: the euro rose

Market news

European session: the euro rose

10:00 Eurozone Industrial production, (MoM) January -0.4% Revised From -0.7% +0.6% -0.2%

10:00 Eurozone Industrial Production (YoY) January +1.2% Revised From +0.5% +1.9% +2.1%

The euro has risen sharply against the U.S. dollar despite weak data on industrial production in the euro area . Official data showed Eurostat, in the euro zone industrial production fell unexpectedly in January , largely due to reduced production of energy.

Industrial output fell 0.2 percent on a monthly basis in January , showing the second consecutive fall. Economists had expected production to grow by 0.6 percent after falling by a revised 0.4 percent in December .

Production of energy decreased by 2.5 percent, and the production of durable consumer goods fell by 0.6 percent . Intermediate goods decreased by 0.1 percent. Partially offset this decline is that the release of capital goods rose by 0.9 percent, while production of consumer non-durable goods increased by 0.4 percent.

On an annual basis, industrial production growth accelerated to 2.1 percent from 1.2 percent in December . Economists forecast that output will grow by 1.9 per cent .

In light of this release analysts ING Bnak NV commented : " The main reason for poor outcome again was to reduce energy production by 2.5% , but intermediate goods and consumer durables also pointed to the decline in production ... While the benchmark is not met expectations , weak energy component probably overshadowed a slight improvement in the overall indicator. However, to strengthen the eurozone recovery process still requires export growth . "

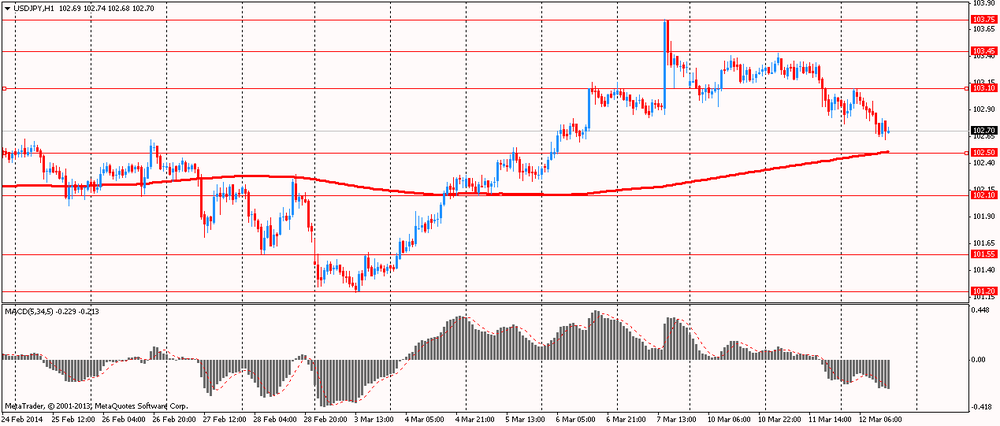

The yen rose against most currencies on concerns about the state of China's economy. This increases the demand for safe-haven assets , which is the yen . In February, China's exports fell by the largest value since the beginning of the financial crisis . Index decreased yoy by 18.1 % , while the experts had expected growth of 7.5%. However, the real picture is quite difficult to evaluate because of the rather long New Year celebrations on the lunar calendar . Holidays in China traditionally distort statistics . Meanwhile, imports grew by 10.1% , resulting in a trade deficit reached highs for 2 years at $ 23 billion

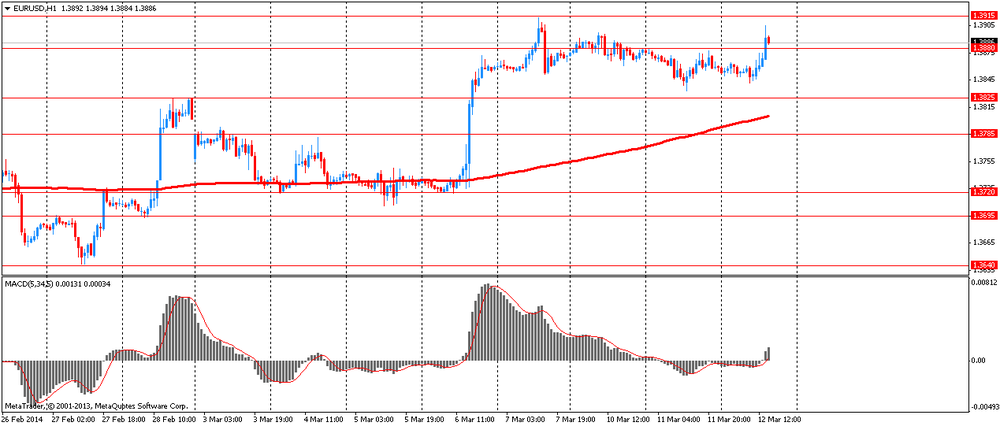

EUR / USD: during the European session, the pair rose to $ 1.3905

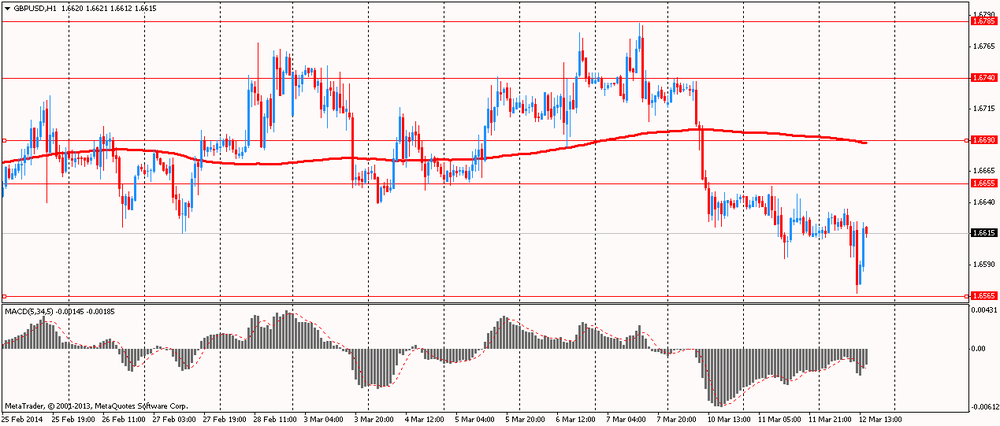

GBP / USD: during the European session, the pair fell to $ 1.6567 and retreated

USD / JPY: during the European session, the pair fell to Y102.62

At 17:01 GMT the United States places the 10 - year bonds . At 18:00 GMT the United States will be released monthly budget execution report . At 20:00 GMT we will know the RBNZ decision on the basic interest rate will be a press conference by the RBNZ will be done RBNZ accompanying statement , the protocol will monetary policy RBNZ . At 23:50 GMT , Japan will publish the change in orders for machinery and equipment in January .