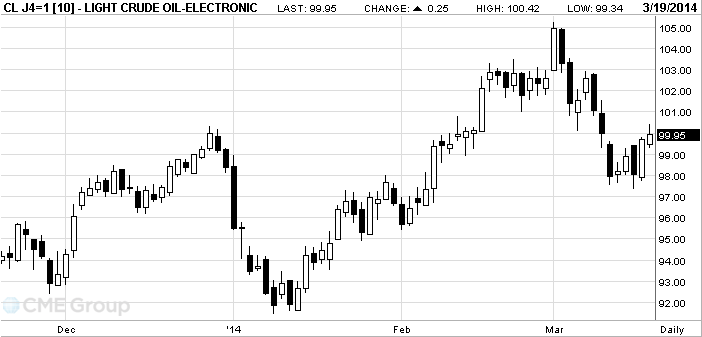

- Oil rose

Market news

Oil rose

West Texas

Intermediate rose after a government report showed that inventories at Cushing,

Oklahoma, the delivery point for the contract, dropped a seventh week. Brent

oil slid.

WTI rose as

much as 0.7 percent. Supplies at Cushing fell 989,000 barrels to 29.8 million

last week, the lowest level since January 2012, the Energy Information

Administration said. Futures also climbed after Enterprise Products Partners LP

said yesterday that operations on the expanded Seaway line to

WTI for

April delivery advanced 58 cents, or 0.6 percent, to $100.28 a barrel at 10:43

a.m. on the New York Mercantile Exchange. The contract traded at $100.23 before

the release of the report at 10:30 a.m. in

Brent for

May settlement dropped 68 cents, or 0.6 percent, to $106.11 a barrel on the

London-based ICE Futures Europe exchange. Trading volume was 13 percent lower

than the 100-day average. The European benchmark’s premium to WTI for the same

month slipped to $7.04 a barrel.

Cushing

stockpiles have fallen since the southern portion of the Keystone XL pipeline

began moving oil to the

Total crude

inventories climbed by 5.85 million barrels to 375.9 million, the EIA said. A

2.75 million-barrel gain was projected, according to the median of 11 analyst

responses in a Bloomberg survey.

Supplies of

distillate fuel, a category that includes heating oil and diesel, fell 3.1

million barrels last week to 110.8 million, the lowest level since May 2008,

according to the EIA, the Energy Department’s statistical arm. Gasoline

stockpiles dropped 1.47 million barrels to 222.3 million.