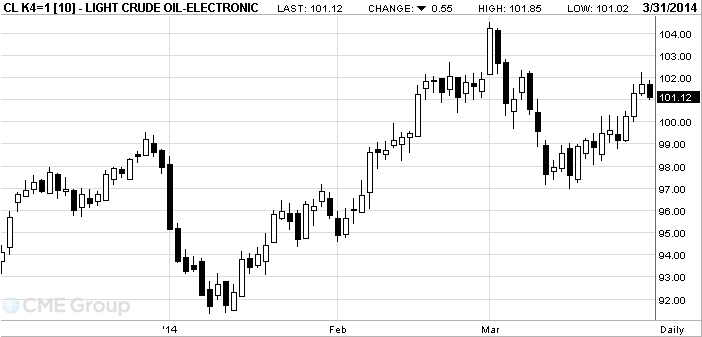

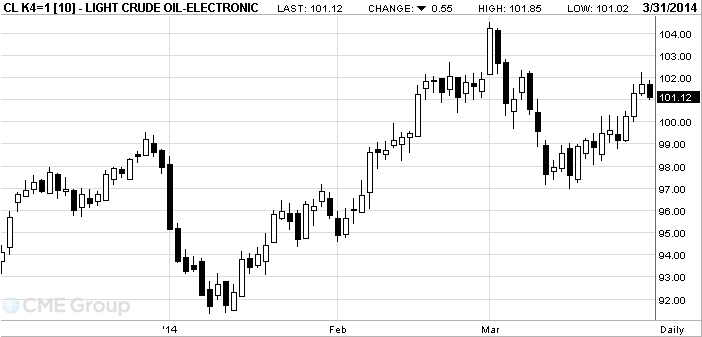

West Texas

Intermediate crude traded near the highest close in three weeks as the U.S. and Russia

sought to defuse the crisis over Ukraine. Brent stayed near a 14-day

peak amid persisting supply disruption from Libya.

Futures

were little changed in New York,

headed for a quarterly advance of 2.9 percent. U.S. Secretary of State John

Kerry said Russia must

withdraw forces that are “creating a climate of fear and intimidation” as his

counterpart in the Kremlin urged the government in Kiev

to give Ukraine’s

regions more autonomy. Supplies at Cushing,

Oklahoma, the delivery point for

WTI, shrank last week for the eighth week to the lowest in two years, the

Energy Information Administration said.

“There is a

looming tension on Crimea,” said Abhishek

Deshpande, oil markets analyst at London-based Natixis. “WTI has been driven by

drawdowns in Cushing which are down 42 percent year-on-year. If it continues at

the current level of decline we could reach the operational lows come the

summer and see WTI cross over Brent as happened last summer.”

WTI for May

delivery was at $101.31 a barrel in electronic trading on the New York

Mercantile Exchange, down 36 cents, at 12:39 p.m. London time. The contract climbed 39 cents to

$101.67 on March 28, the highest close since March 7 and capping a second

weekly increase. The volume of all futures traded was about 33 percent below

the 100-day average.

Brent for

May settlement was at $107.81 a barrel, down 24 cents on the London-based ICE

Futures Europe exchange. The March 28 close was the highest since March 14. The

European benchmark crude was at a premium of $6.53 to WTI. The spread narrowed

for a third day on March 28 to close at $6.40.

Brent is

poised for a decline of 2.7 percent this quarter.