- Oil fell

Market news

Oil fell

West

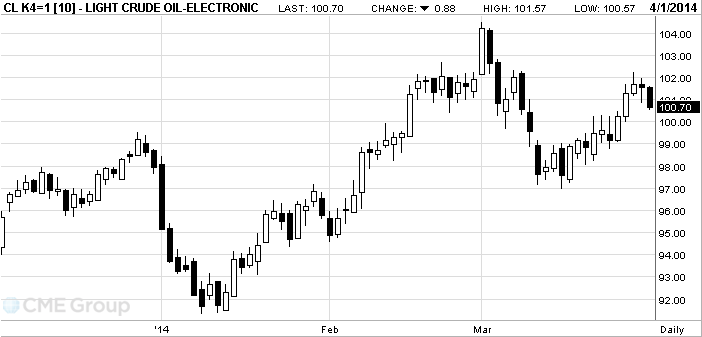

WTI dropped

as much as 1 percent. Stockpiles may have climbed 2.5 million barrels last

week, according to a Bloomberg survey before a government report scheduled for

release tomorrow. The Institute for Supply Management’s index reached

“All the

news is bearish today,” said Michael Lynch, president of Strategic Energy &

Economic Research in

WTI for May

delivery declined 87 cents, or 0.9 percent, to $100.71 a barrel at 10:12 a.m.

on the New York Mercantile Exchange. The volume of all futures traded was 18

percent below the 100-day average. Prices dropped 1 percent in March.

Brent crude

for May settlement slid 60 cents, or 0.6 percent, to $107.16 a barrel on the

London-based ICE Futures Europe exchange. Volume was 25 percent below the

100-day average. The European benchmark was at a $6.45 premium to WTI after

closing at $6.18 yesterday.