- Oil rose

Market news

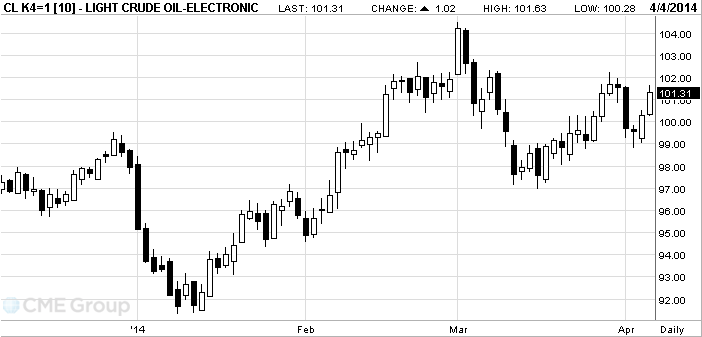

Oil rose

West Texas Intermediate and Brent crudes rose for a second day

after U.S. employers increased payrolls in March, signaling fuel consumption

may climb in the world’s biggest oil-consuming country.

Futures advanced as much as 1.1 percent in New York, trimming a

weekly decline. Payrolls grew 192,000 after a 197,000 gain in February that was

larger than first estimated, Labor Department data showed today. The

unemployment rate held at 6.7 percent. Brent also rallied as rebels continued

to block exports from Libya’s east as traders await a possible resumption.

“This data shows that the U.S. economy is doing better, which

bodes well for oil demand,” said Addison Armstrong, director of market research

at Tradition Energy in Stamford, Connecticut. “We’re all keeping an eye on

developments in Libya. If there’s a resolution and the oil starts to move, we

could turn around and test the recent lows.”

WTI for May delivery increased $1.04, or 1 percent, to $101.33 a

barrel at 10:32 a.m. on the New York Mercantile Exchange. Prices are down 0.3

percent this week. The volume of all futures traded was 1.2 percent below the

100-day average.

Brent for May settlement rose 67 cents, or 0.6 percent, to $106.82

a barrel on the London-based ICE Futures Europe exchange. The contract is down

1.2 percent this week. Volume was 14 percent higher than the 100-day average. The

European benchmark crude traded at a $5.49 premium to WTI.