- European session: the euro rose

Market news

European session: the euro rose

06:00 Germany Industrial Production s.a. (MoM) February +0.7% Revised From +0.8% +0.3% +0.4%

06:00 Germany Industrial Production (YoY) February +4.9% Revised From +5.0% +4.8%

07:00 Switzerland Foreign Currency Reserves March 433.5 437.9

07:15 Switzerland Consumer Price Index (MoM) March +0.1% +0.2% +0.4%

07:15 Switzerland Consumer Price Index (YoY) March -0.1% -0.1% 0.0%

08:30 Eurozone Sentix Investor Confidence April 13.9 13.7 14.1

09:40 Eurozone ECB's Yves Mersch Speaks

10:30 Eurozone ECB's Jens Weidmann Speaks

Euro traded upward against the dollar on better forecasts published statistics. Investor confidence in the eurozone unexpectedly strengthened in April , showed on Monday poll , conducted by the research center Sentix. Investor sentiment index rose to 14.1 in April , its highest level since April 2011, from 13.9 in March. According to forecasts , the index was down to 13.7 . Assessment of the current situation rose to 5.8 from 4.8 points in the previous month . The result was the highest since July 2011 . Meanwhile, the expectations index fell for the second consecutive month in April , to 22.8 from 23.5 in March.

Index of industrial production in Germany grew faster than expected in February , said the country's statistics office on Monday , showing a strong start in Europe's largest economy this year. Industrial production increased by 0.4 % per month , adjusted in February , beating economists' expectations +0.3 % m / m Value in January was revised downward to 0.7 % from 0.8 %. During the year, industrial production increased by 4.8 % in February.

"In general, the industrial sector remained strong in the first quarter , despite the challenges from the strong euro and some geopolitical uncertainty , " - said Annalisa Piazza , economist at Newedge. Data came after unexpectedly strong factory orders in February. Total production orders on a monthly basis by 0.6 % , adjusted for inflation , working days and seasonal effects .

Support for the single currency was a representative of the ECB Nowotny comments . Member of the Management Board of the European Central Bank Ewald Nowotny said that he still believes the risk of deflation in the euro zone limited , adding : ECB has a wide range of tools in case you need . Nowotny said that there is a wide range of tools , but not a priority.

As for the future launch of quantitative easing (QE), then Nowotny does not exclude any type of asset purchases , if necessary , but he personally prefers buying securities backed by assets (asset-backed security, ABS). Nowotny added that the need to strengthen the ABS market in the eurozone. Nowotny also voiced expectations of renewed growth in the prices of services in Germany in the near future , which should alleviate the problem of low inflationary pressures.

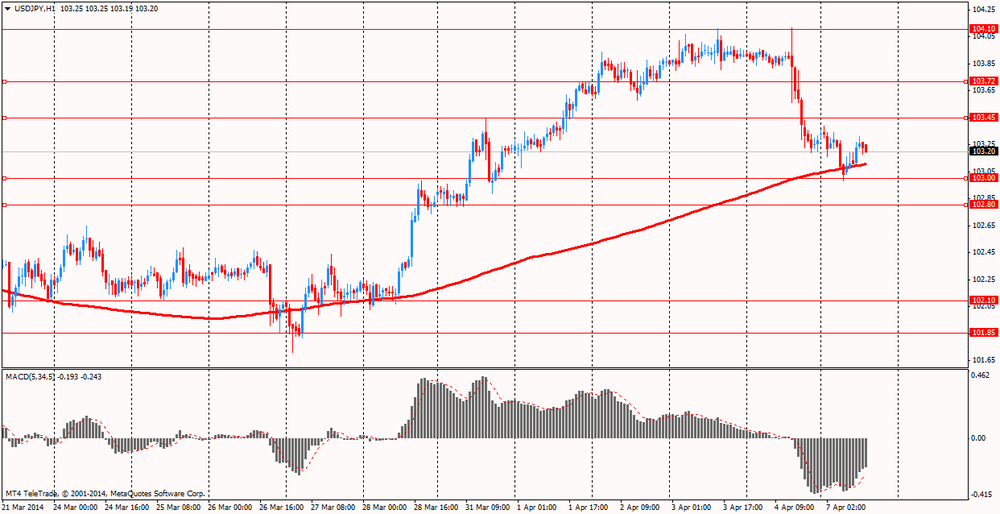

At the moment, the yen stabilized pending the outcome of two -day meeting of the Bank of Japan , the announcement of which will be held tomorrow . It is worth noting that this is the first meeting after April 1 the government increased the sales tax in the country. According to the median forecast of economists at the current meeting, the Central Bank is likely to decide to leave its monetary policy settings unchanged. However, there is a high probability that in the coming months, the Bank of Japan may double asset purchase .

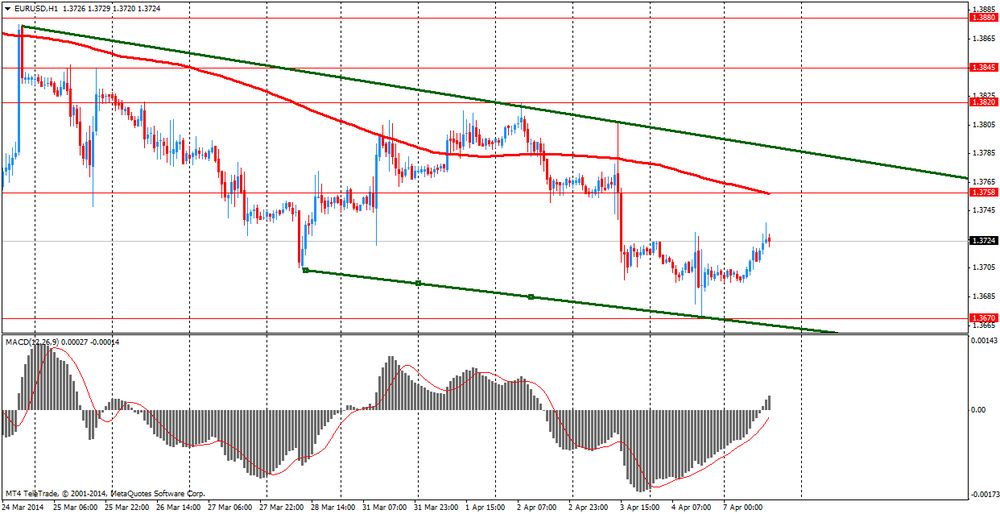

EUR / USD: during the European session, the pair rose to $ 1.3737

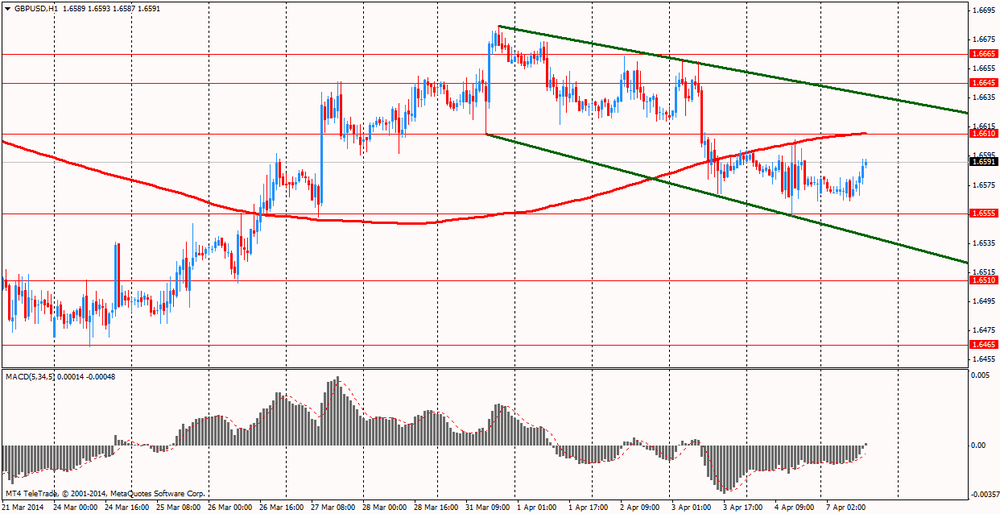

GBP / USD: during the European session, the pair rose to $ 1.6593

USD / JPY: during the European session, the pair fell to Y102.98 and then increased to 103.31

At 14:30 GMT , Canada will release indicator of expectations in the field of credit and financial institutions , according to the Bank of Canada for the 1st quarter . At 22:00 GMT New Zealand will release the sentiment indicator from the NZIER business environment for the 1st quarter . At 23:50 GMT Japan will total current account surplus and total adjusted current account surplus for February.