- Oil fell

Market news

Oil fell

Brent

crude dropped from a five-week high as Libya’s National Oil Corp. prepared to

resume exports from its Hariga terminal. West Texas Intermediate slipped below

$104 on U.S. inventory forecasts.

Brent’s

premium to WTI shrank. A tanker will arrive at the port in eastern Libya today

to load 1 million barrels of crude, according to Libya’s Arabian Gulf Oil. U.S.

supplies probably grew from a four-month high, a Bloomberg survey showed before

an Energy Information Administration report tomorrow. WTI reduced losses as

U.S. stocks advanced.

“It

looks like Libya is getting some oil out and it’s putting some downward

pressure on oil,” said John Kilduff, a partner at Again Capital LLC, a New

York-based hedge fund that focuses on energy. “We are going to see another

build in inventories. The elements are in place for the price to go much

lower.”

Brent

for May settlement decreased 37 cents, or 0.3 percent, to $108.70 a barrel on

the London-based ICE Futures Europe exchange at 10:41 a.m. New York time.

Prices ended the session at $109.07 yesterday, the most since March 4. The May

contract expires today. The more-active June futures slipped 15 cents to

$108.92. The volume of all futures was 7.8 percent above the 100-day average.

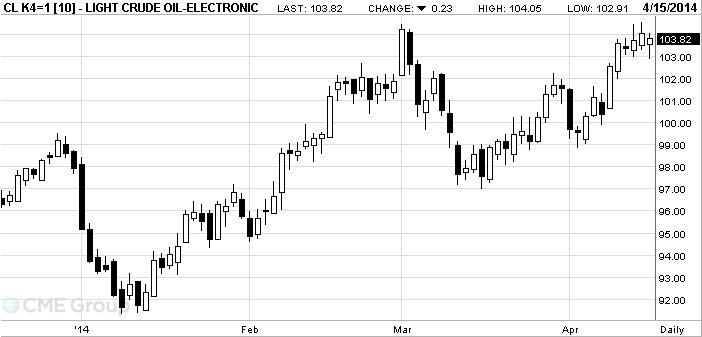

WTI for

May delivery slipped 8 cents to $103.97 a barrel on the New York Mercantile

Exchange. The contract climbed to $104.05 yesterday, the highest settlement

since March 3. It’s up 5.6 percent this year. The volume of all futures was 10

percent above the 100-day average.