- Foreign exchange market. Asian session: The Australian dollar increased ahead the inflation figures publication

Market news

Foreign exchange market. Asian session: The Australian dollar increased ahead the inflation figures publication

Economic calendar (GMT0):

00:00 Australia Conference Board Australia Leading Index February +0.2% +0.3%

The U.S. dollar rose to two-week highs against the yen. Japan’s trade deficit caused this development.

The New Zealand dollar declined ahead the Reserve Bank of New Zealand interest rate decision on Thursday. The Reserve Bank of New Zealand could increase interest rate by 25 basis points to 3.0%. The increase of interest rate could be questioned after the weaker-than-expected inflation figures last week. The statement of the New Zealand’s central bank could play an important role.

The Australian dollar increased against the most major currencies while the markets are awaiting the inflation data publication tomorrow. There is speculation that the Reserve Bank of Australia could raise interest rates. The forecast for the Australian annual inflation in the first quarter of the year is 3.2%, the highest rise in over two years. This figure exceeds the inflation target of the Reserve Bank of Australia (target: 2-3%).

The Japanese Yen dropped against the U.S. dollar and the euro after Japan’s trade deficit rose. Japan’s trade deficit declined to US$14 billion in March. New quantitative stimulus measures are expected by the market participants.

EUR/USD: the currency pair was traded in the range $1.3790-00

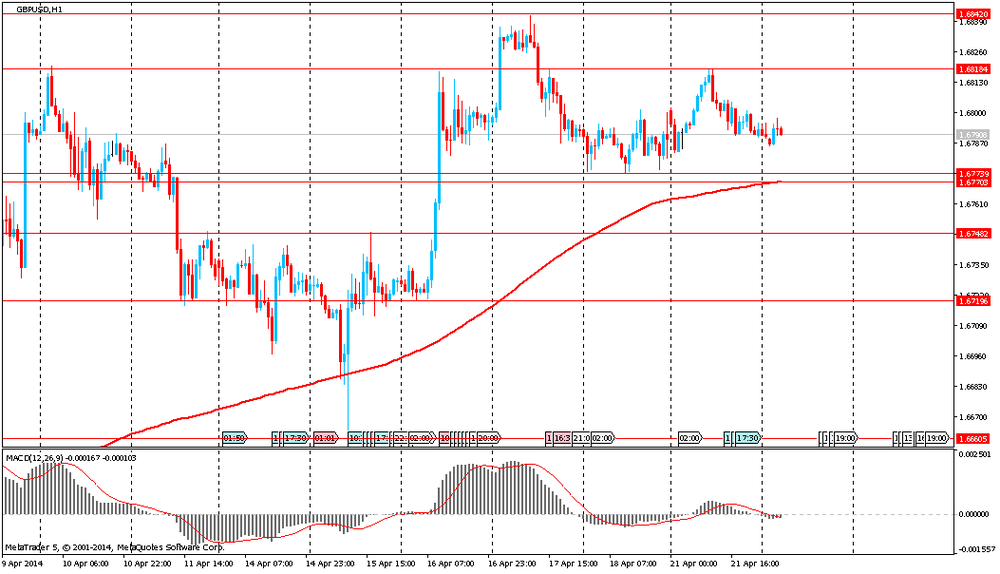

GBP/USD: the currency pair was traded in the range $1.6785-95

USD/JPY: the currency pair reached Y102.70

The most important news that are expected (GMT0):

12:30 | Canada | Wholesale Sales, m/m | February | +0.8% | +0.7% |

13:00 | U.S. | Housing Price Index, m/m | February | +0.5% | |

13:00 | U.S. | Housing Price Index, y/y | February | +7.4% | |

14:00 | Eurozone | Consumer Confidence | April | -9 | -9 |

14:00 | U.S. | Richmond Fed Manufacturing Index | April | -7 | 0 |

14:00 | U.S. | Existing Home Sales | March | 4.60 | 4.57 |