- Foreign exchange market. Asian session: the Japanese yen traded lower against the U.S. dollar after Japan’s weaker-than-expected inflation data

Market news

Foreign exchange market. Asian session: the Japanese yen traded lower against the U.S. dollar after Japan’s weaker-than-expected inflation data

Economic calendar (GMT0):

04:30 Japan All Industry Activity Index, m/m February +1.0% -0.5% -1.1%

08:00 Switzerland SNB Chairman Jordan Speaks

08:30 United Kingdom Retail Sales (MoM) March +1.7% -0.4% +0.1%

08:30 United Kingdom Retail Sales (YoY) March +3.7% +3.8% +4.2%

08:30 United Kingdom BBA Mortgage Approvals March 47.6 48.9 45.9

The U.S.

dollar declined against the most major currencies. Tensions between Russia and

Ukraine have a negative influence. Investors are concerned that an escalation

of the Ukraine crisis is imminent. They also concerned the USA will be increasingly

involved in the Ukraine crisis and that will burden the U.S. economy

Stock markets

in Australia and New Zealand were closed for the public holiday. There were no significant

price movements.

The

Japanese yen traded lower against the U.S. dollar after the inflation data

publication. Tokyo Consumer Price Index rose 1.3% in April. It is the same

increase as in the previous month. Tokyo CPI excluding fresh food climbed 2.7%

in April from 1.0% in March. The rise of CPI did not meet the expectations.

Analysts forecasted the increase of 2.7%.

National

Consumer Price Index improved from the previous month. The index climbed 1.6%

in March (February: 1.5%). National CPI excluding fresh food did not meet the

expectations. The index was up 1.3%, expected the rise of 1.4%.

Investors

think that the Japan’s inflation will decline later this year. If it actually

happens, the Bank of Japan could trigger new easing action. But the Bank of

Japan Governor Haruhiko Kuroda is convinced Japan’s inflation is on a path to

reach the target of 2.0%.

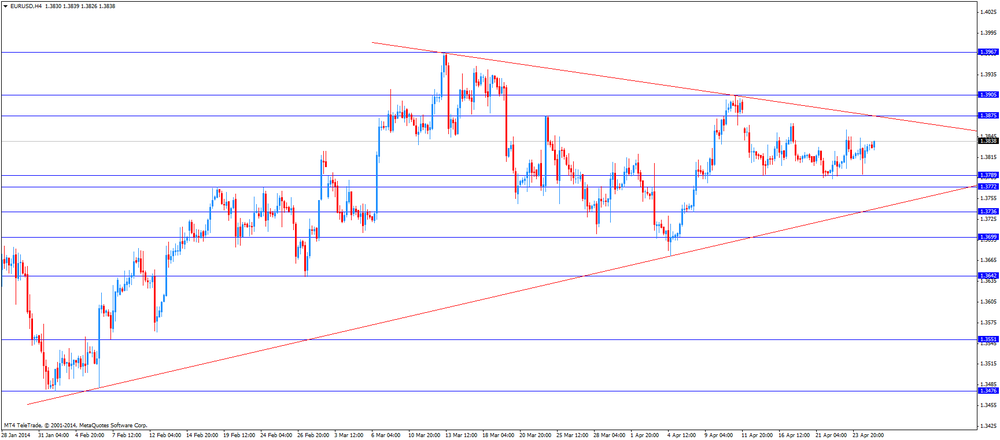

EUR/USD: the currency pair climbed to $1.3835

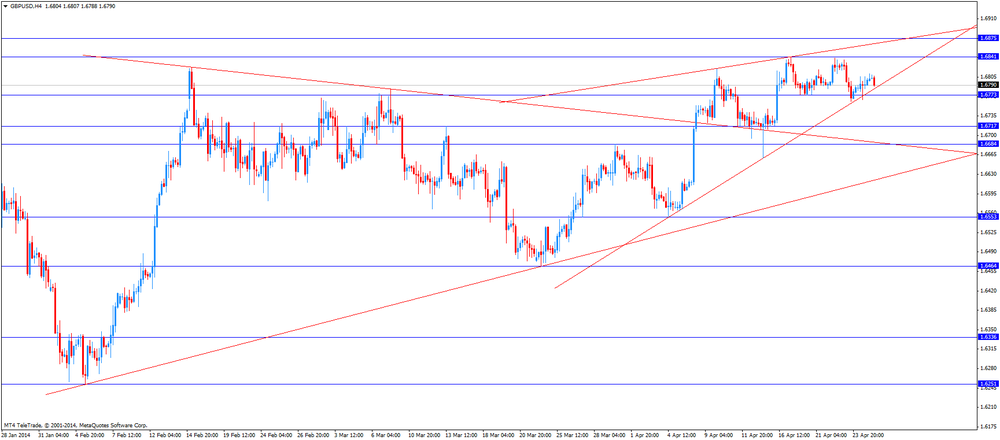

GBP/USD: the currency pair was up to $1.6810

USD/JPY: the currency pair rose to Y102.50

The most important news that are expected

(GMT0):

13:43 U.S. Services PMI (Preliminary) April 55.3 56.2

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) April 82.6 83.2