- Foreign exchange market. European session: the euro increased against the U.S. dollar but lost its gains

Market news

Foreign exchange market. European session: the euro increased against the U.S. dollar but lost its gains

Economic calendar:

04:30 Japan All Industry Activity

Index, m/m February +1.0% -0.5%

-1.1%

08:00 Switzerland SNB Chairman Jordan Speaks

08:30 United Kingdom Retail Sales (MoM) March +1.7% -0.4%

+0.1%

08:30 United Kingdom Retail Sales (YoY) March +3.7% +3.8%

+4.2%

08:30 United Kingdom BBA Mortgage Approvals March 47.6 48.9

45.9

The euro increased

against the U.S. dollar but lost its gains. There are no economic data to be

published in the Eurozone.

The U.S.

dollar traded lower against the most major currencies ahead the publication of Reuters/Michigan

Consumer Sentiment Index. Analysts forecasted the increase to 83.2 in April

from 82.6 in March.

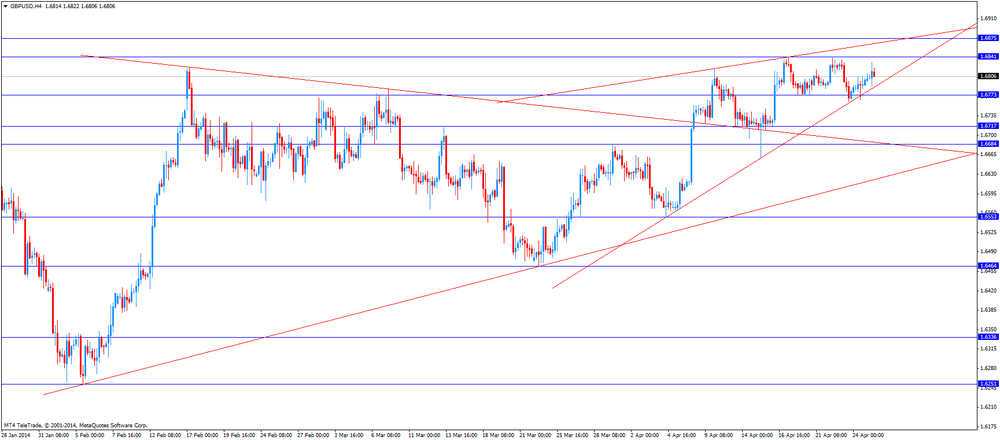

The British

pound was up the U.S. dollar. The British currency was supported by the

better-than-expected retail sales. Retail sales increased 0.1% in March.

Analysts forecasted the fall of 0.4%. But the mortgage approvals dropped to

45,900 in March. The projected figure was 48,900. The mortgage approvals in

February were revised down to 47,200 from 47,600.

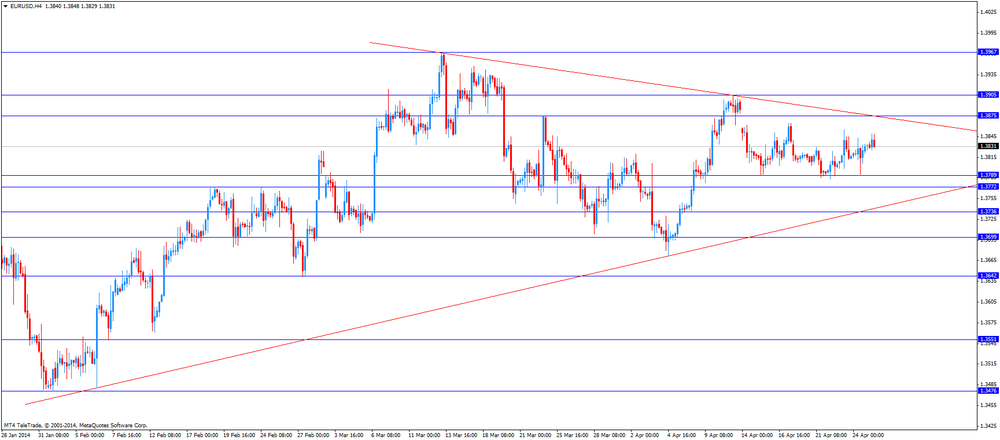

EUR/USD:

the currency pair traded mixed

GBP/USD:

the currency pair traded mixed

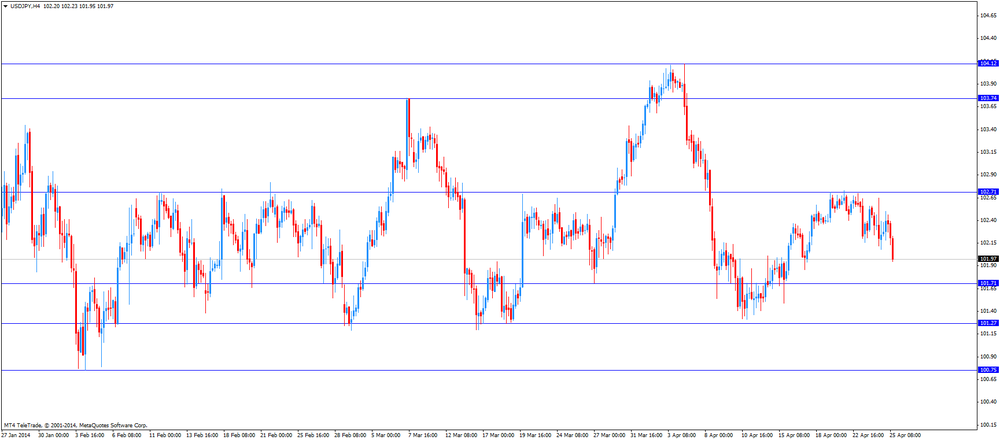

USD/JPY:

the currency pair declined to Y101.95

The most important news that are expected

(GMT0):

13:43 U.S.

Services PMI

(Preliminary)

April 55.3 56.2

13:55 U.S. Reuters/Michigan

Consumer Sentiment Index (Finally)

April 82.6 83.2