- Foreign exchange market. Asian session: the Australian dollar increased to 1-month highs against the U.S. dollar, supported by the Australian federal budget 2014

Market news

Foreign exchange market. Asian session: the Australian dollar increased to 1-month highs against the U.S. dollar, supported by the Australian federal budget 2014

Economic

calendar (GMT0):

06:00 Germany CPI, m/m (Finally) April -0.2% -0.2% -0.3%

06:00 Germany CPI, y/y (Finally) April +1.3% +1.3% +1.1%

06:00 Japan Prelim Machine Tool Orders, y/y April +41.8% +48.8%

06:45 France CPI, m/m April +0.4% +0.2% 0.0%

06:45 France CPI, y/y April +0.6% +0.8%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April +1.4% +1.3%

08:30 United Kingdom Average Earnings, 3m/y March +1.7% +2.2% +1.7%

08:30 United Kingdom Claimant count April -30.4 -31.2 -25.1

08:30 United Kingdom Claimant Count Rate April 3.4% 3.3%

08:30 United Kingdom ILO Unemployment Rate March 6.9% 6.8% 6.8%

09:00 Eurozone Industrial production, (MoM) March +0.2% -0.3% -0.3%

09:00 Eurozone Industrial Production (YoY) March +1.7% -0.1%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) March 7.0 7.4

The U.S.

dollar traded lower against the most major currencies. Yesterday’s released

U.S. retail sales has been weaker than expected. U.S. retail sales increased

0.1% in April, from a 1.2% rise in March. March’s figure was revised up from

1.1%. Analysts had expected an increase of 0.5%. U.S. retail sales excluding

autos were flat in April (March: +0.7%). Analysts had forecasted a 0.6% increase.

The New

Zealand dollar traded higher against the U.S. dollar despite the lower-than-expected

retail sales data from New Zealand. Retail sales in New Zealand increased 0.7%

in the first quarter, from a 1.2% rise in the previous quarter. Analysts had

expected a 0.9% increase. Retail sales excluding automobiles and gas stations

climbed 0.8% in the first quarter, from a 1% increase in the previous quarter.

The fourth quarter figure was revised up from 0.7%. Analysts had forecasted a

0.9% gain.

The Reserve

Bank of New Zealand released its Financial Stability Report. House sales

declined 11% between October and March since the central bank imposed the

restrictions on high loan-to-value ratio lending.

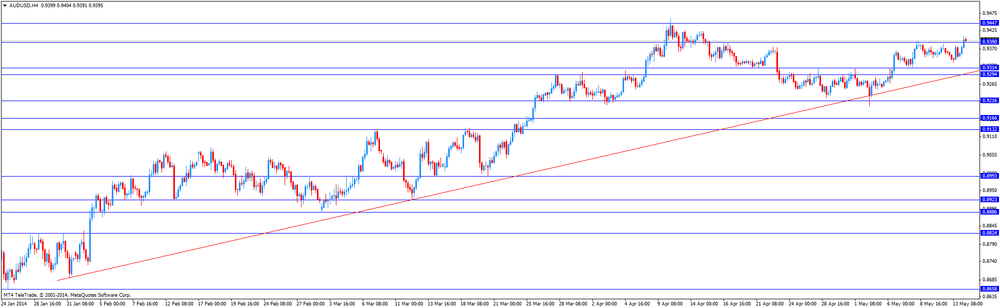

The

Australian dollar increased to 1-month highs against the U.S. dollar, supported

by the Australian federal budget 2014. Australia's Treasury released the

federal budget for 2014 – 2015 on Tuesday. Australia's treasurer Joe Hockey said

that the government aims to halve its budget deficit over the next year. The

Australian government wants to cut tax increases and spending cuts in the

budget to achieve its goal. Australia's Treasury forecast a deficit of A$29.8

billion during the twelve months ended June 2015. The real GDP should grow 2.5%

in 2014 – 2015.

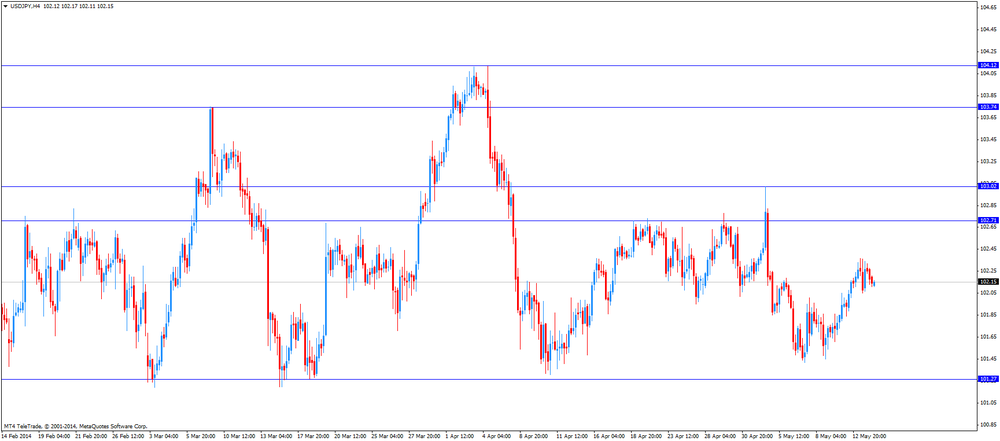

The

Japanese yen increased against the U.S. dollar, supported by the

better-than-expected economic data out of Japan. Corporate Goods Price Index

(CGPI) increased 4.1% in April, from a 1.7% rise in March. Machine tool orders

(preliminary) rose 48.8% in April, from a 41.8% gain in March.

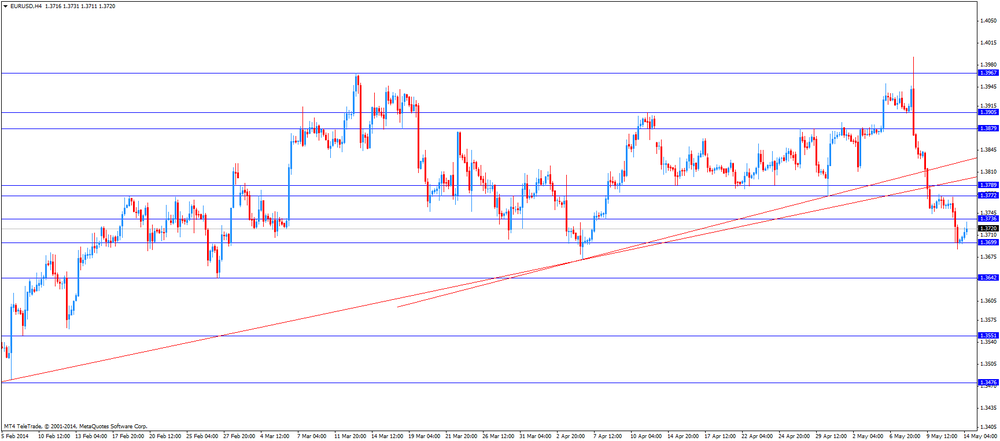

EUR/USD:

the currency pair increased to $1.3720

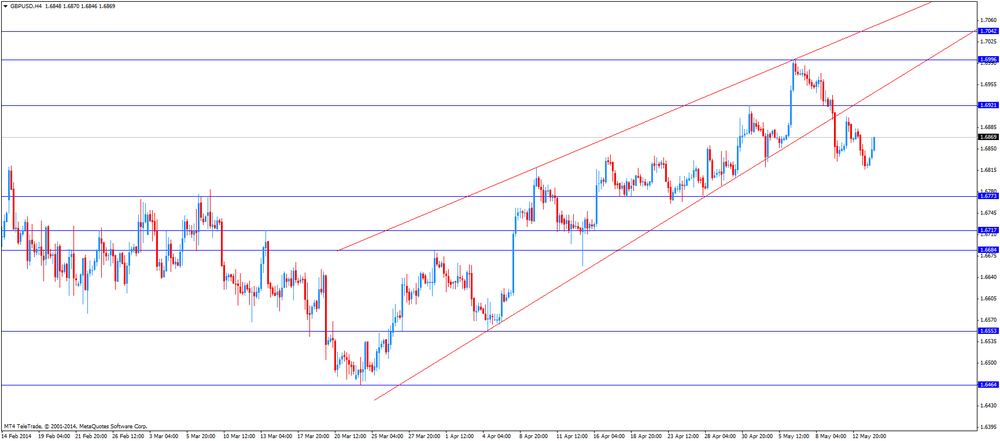

GBP/USD:

the currency pair climbed to $1.6870

USD/JPY:

the currency pair declined to Y102.10

AUD/USD: the currency pair climbed to $0.9397

The most

important news that are expected (GMT0):

09:30 United Kingdom BOE Inflation Letter Quarter II

09:30 United Kingdom BOE Gov Mark Carney Speaks

12:30 U.S. PPI, m/m April +0.5% +0.2%

12:30 U.S. PPI, y/y April +1.4%

12:30 U.S. PPI excluding food and energy, m/m April +0.6% +0.2%

12:30 U.S. PPI excluding food and energy, Y/Y April +1.4%

14:30 Eurozone ECB's Jens Weidmann Speaks

22:30 New Zealand Business NZ PMI April 58.4

23:50 Japan Tertiary Industry Index March -1.0% +2.5%

23:50 Japan GDP, q/q (Preliminary) Quarter I +0.2% +1.0%

23:50 Japan GDP, y/y Quarter I +2.6%