- Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data

Market news

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data

Economic

calendar (GMT0):

01:30 Australia Private Sector Credit, m/m April +0.4%

+0.4% +0.5%

01:30 Australia Private Sector Credit, y/y April

+4.4% +4.6%

05:00 Japan Housing Starts, y/y April -2.9%

-8.2% -3.3%

06:00 Germany Retail sales, real adjusted April -0.7%

+0.4% -0.9%

06:00 Germany

Retail sales, real

unadjusted, y/y April -1.9% +3.4%

07:00 Switzerland KOF Leading Indicator May 101.8

102.05 99.8

The U.S.

dollar traded mixed against the most major currencies ahead of the release of the

U.S. economic data. Personal income in the U.S. should increase 0.3% in April, after

0.5% gain in March. Personal spending in the U.S. should rise 0.2% in April,

after a 0.9% increase in March. Chicago Purchasing Managers' Index should

decline to 60.2 in May from 63.0 in April. Reuters/Michigan Consumer Sentiment

Index should increase to 82.9 in May from 82.8 in April.

The euro traded

higher against the U.S. dollar. The German adjusted retail sales dropped 0.9%

in April, after a 0.7% decline in March. Analysts had expected a 0.4% rise.

The

unadjusted retail sales in Germany climbed 3.4% in April, after a decrease of

1.9% in March.

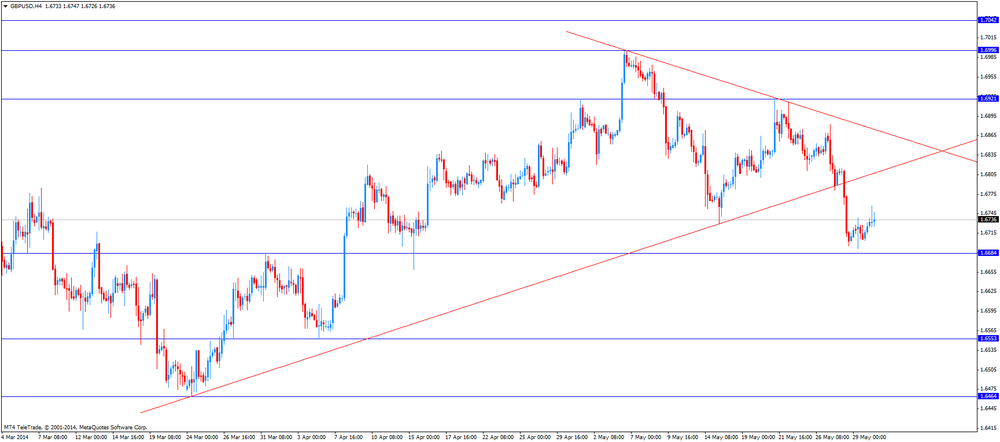

The British

pound traded higher against the U.S. dollar in the absence of any major

economic reports in the U.K.

The Swiss

franc traded mixed against the U.S. dollar. KOF leading indicator for

Switzerland dropped to 99.8 in May from 101.8 in April. April’s figure was

revised down to 101.8 from 102.04. Analysts had expected an increase to 102.05.

The

Canadian dollar traded higher against the U.S. dollar amid the Canadian gross

domestic product. The Canadian GDP should increase 0.1% in March, after a 0.2%

gain in February.

The raw material

price index in Canada should climb 1.2% in April, after a 0.6% rise in March.

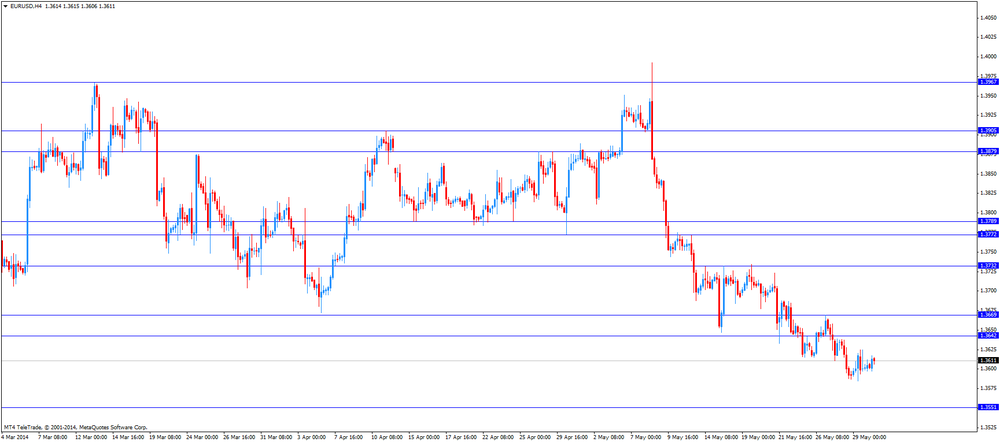

EUR/USD:

the currency pair increased to $1.3617

GBP/USD:

the currency pair climbed to $1.6757

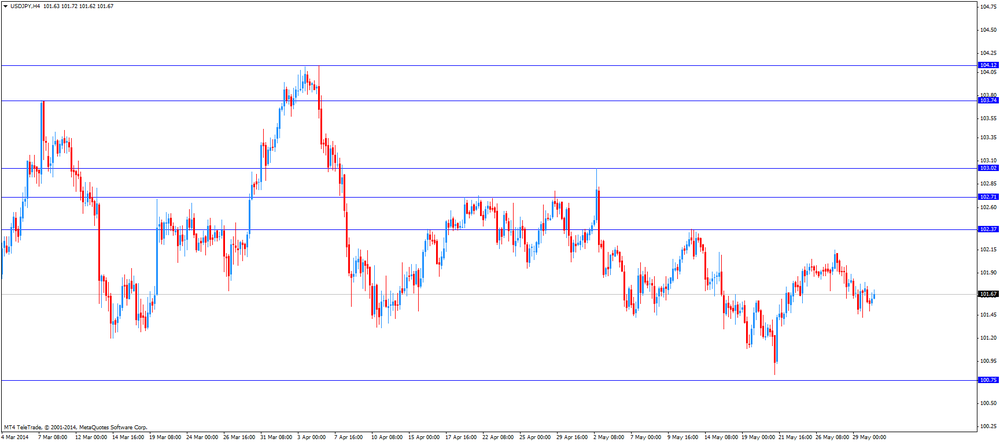

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

12:30 Canada

Raw Material Price Index April +0.6%

+1.2%

12:30 Canada

GDP (m/m)

March +0.2% +0.1%

12:30 U.S.

Personal Income, m/m

April +0.5% +0.3%

12:30 U.S.

Personal spending

April +0.9% +0.2%

12:30 U.S.

PCE price index ex food, energy, m/m April +0.2%

+0.2%

12:30 U.S.

PCE price index ex food, energy,

Y/Y April +1.2%

13:45 U.S.

Chicago Purchasing Managers' Index May 63.0

60.2

13:55 U.S.

Reuters/Michigan Consumer Sentiment Index (Finally) May

82.8 82.9

21:00 U.S.

FOMC Member Charles Plosser Speaks