- Foreign exchange market. European session: the euro traded lower against the U.S. dollar

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar

Economic

calendar (GMT0):

01:00 Australia Consumer Inflation Expectation June 4.4% 4.0%

01:30 Australia Changing the number of employed May

10.3 10.3 -4.8

01:30 Australia Unemployment rate May 5.8%

5.9% 5.8%

06:45 France CPI, m/m May

0.0% +0.1% 0.0%

06:45 France CPI, y/y

May +0.7% +0.8%

08:00 Eurozone

ECB Monthly Report June

09:00 Eurozone Industrial production, (MoM) April -0.3% +0.5% +0.8%

09:00 Eurozone Industrial Production (YoY) April -0.1% +0.9% +1.4%

The U.S.

dollar traded mixed against the most major currencies ahead of the U.S. initial

job claims and retail sales. The number of initial jobless claims should

decline by 6,000 to 306,000.

Retail

sales in the U.S. should climb 0.5% in May, after a 0.1% gain in April. Retail

sales excluding autos should increase 0.4%.

The euro

traded lower against the U.S. dollar. Market participants remained unimpressed

by the better-than-expected industrial production in the Eurozone. The

industrial production in the Eurozone increased 0.8% in April, beating

expectations for a 0.5% gain, after a 0.3% decline in March.

On a

year-over-year basis, Eurozone’s industrial production rose 1.4% in April,

exceeding expectations for a 0.9% increase, after a 0.1% fall in March.

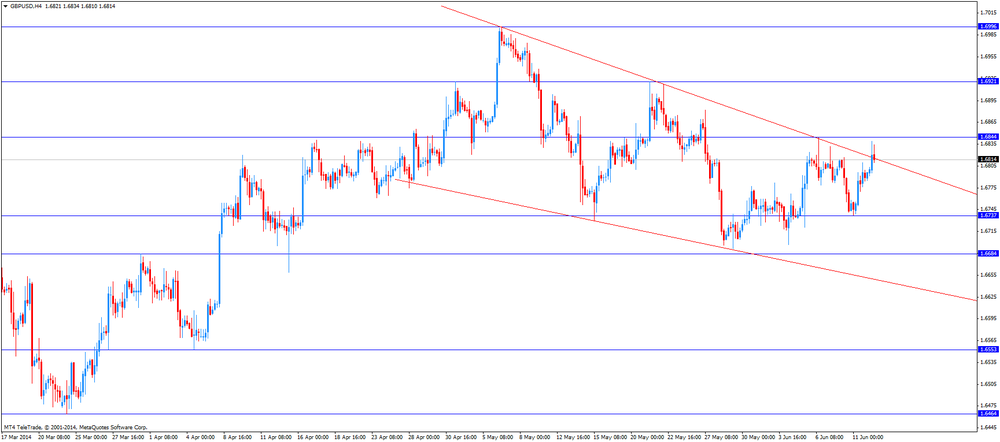

The British

pound traded higher against the U.S. dollar. The British currency was still

supported by the yesterday’s strong U.K. labour market data. The U.K.

unemployment rate fell to 6.6% in the three months to April. Jobless claims

(claimant count) declined by 27,400 in May.

The

Canadian dollar traded mixed against the U.S. dollar ahead of the new housing price

index in Canada and the speech of the Bank of Canada Governor Stephen Poloz. The

new housing price index in Canada should rise 0.3% in April, after a 0.2% gain

in March.

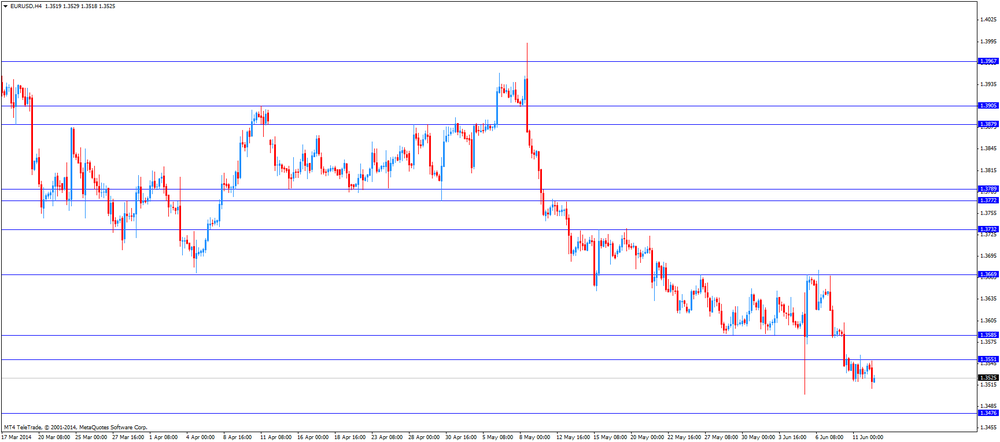

EUR/USD:

the currency pair declined to $1.3510

GBP/USD:

the currency pair climbed to $1.6839

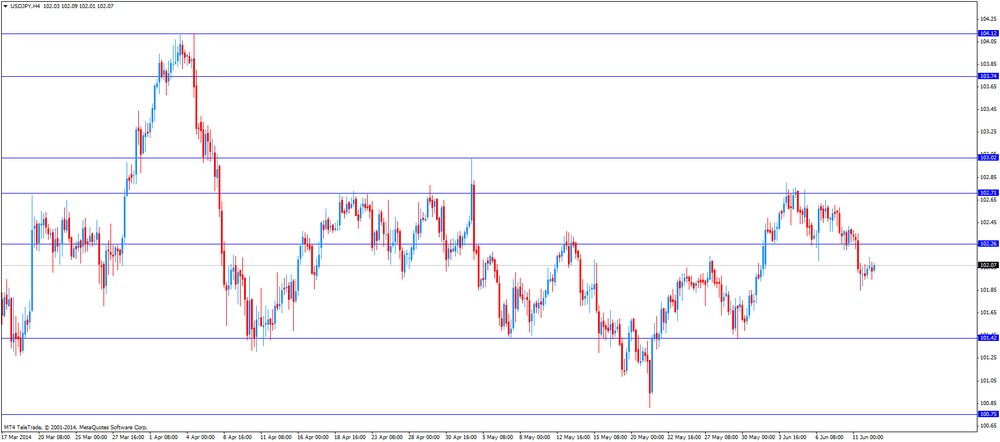

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

12:30 Canada New Housing Price Index April +0.2%

+0.3%

12:30 U.S. Retail sales May +0.1%

+0.5%

12:30 U.S. Retail sales excluding

auto May 0.0%

+0.4%

12:30 U.S. Initial Jobless Claims June 312

306

12:30 U.S. Import Price Index May -0.4%

+0.2%

14:00 U.S. Business inventories April +0.4%

+0.4%

15:15 Canada BOC Gov Stephen Poloz Speaks

22:30 New Zealand Business NZ PMI May 55.2

22:45 New Zealand Food Prices Index, m/m May

+0.6%

22:45 New Zealand Food Prices Index, y/y May +1.5%