- Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead Fed's monetary policy meeting

Market news

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead Fed's monetary policy meeting

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence June 7 8

05:00 Japan Eco Watchers Survey: Current June 45.1 49.2 47.7

05:00 Japan Eco Watchers Survey: Outlook June 53.8 53.3

06:00 Germany Trade Balance May 17.7 15.7 18.8

06:45 France Trade Balance, bln June -4.1 Revised From -3.9 -4.1 -4.9

07:15 Switzerland Retail Sales Y/Y May +0.4% +1.5% -0.6%

07:15 Switzerland Consumer Price Index (MoM) June +0.3% +0.1% -0.1%

07:15 Switzerland Consumer Price Index (YoY) June +0.2% +0.2% 0.0%

08:30 United Kingdom Industrial Production (MoM) May +0.4% +0.3% -0.7%

08:30 United Kingdom Industrial Production (YoY) May +3.0% +3.1% +2.3%

08:30 United Kingdom Manufacturing Production (MoM) May +0.4% +0.5% -1.3%

08:30 United Kingdom Manufacturing Production (YoY) May +4.4% +5.6% +3.7%

09:00 Eurozone ECOFIN Meetings

09:00 Eurozone ECB's Vitor Constancio Speaks

The U.S. dollar traded higher against the most major currencies ahead Fed's monetary policy meeting. The U.S. currency remained under pressure after yesterday's comments by Minneapolis Fed President Narayana Kocherlakota. He said that inflation in the U.S. was more likely to be under Fed's 2% target until 2018. That may mean that interest rate in the U.S. will remain at the low level for a longer period.

Market participants are awaiting the release of the last Fed's monetary policy meeting today. They will be looking for any signs of the recovery of the world's largest economy. There are speculations that stronger employment data may lead to interest rate hike by the Fed.

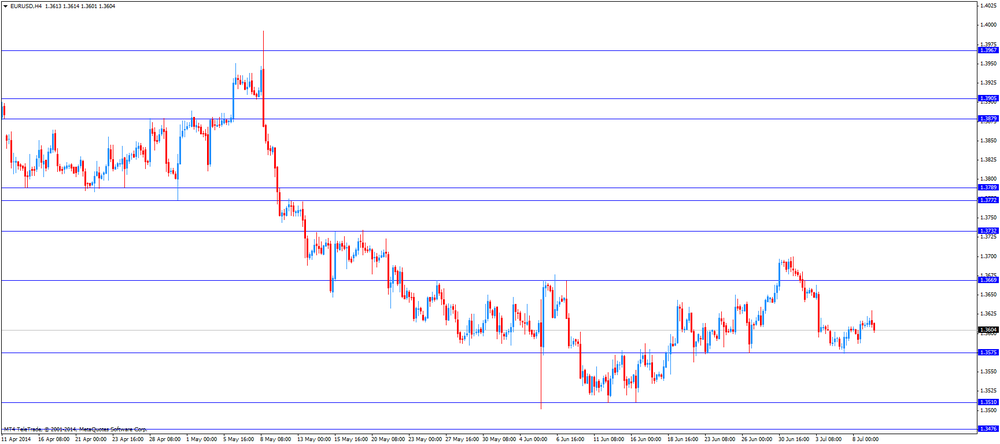

The euro traded lower against the U.S. dollar in the absence of any major economic reports in the Eurozone.

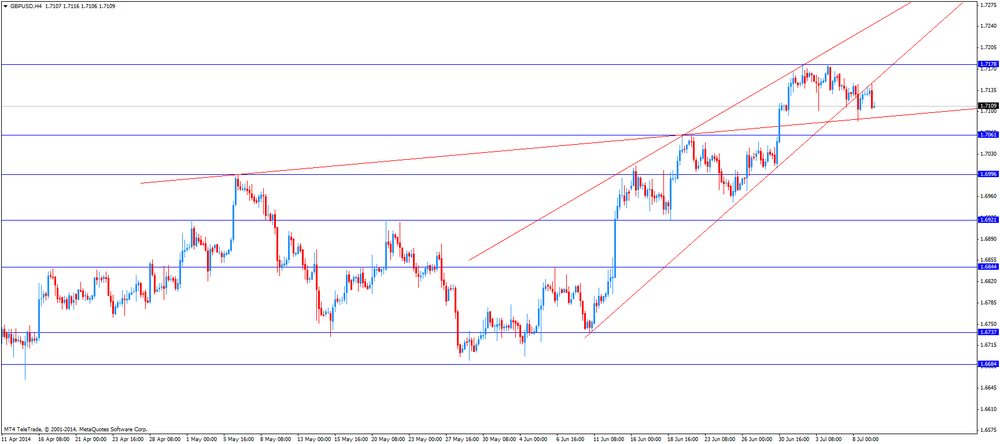

The British pound fell against the U.S. dollar after the Halifax house price index. The Halifax house price index declined 0.6% in June, missing expectations for a 0.3% fall, after a 3.9% rise in May.

On a yearly basis, the Halifax house price index rose 8.8% in June, after a 8.7% gain in May.

The Canadian dollar traded higher against the U.S. dollar ahead of the housing starts in Canada. The number of housing starts in Canada should be 191,000 units in June, after 198,000 units in May.

EUR/USD: the currency pair declined to $1.3601

GBP/USD: the currency pair decreased to $1.7104

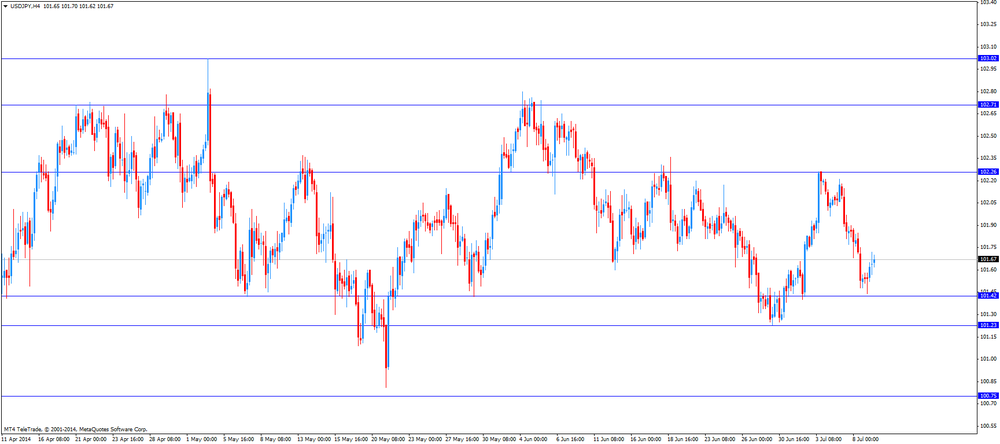

USD/JPY: the currency pair climbed to Y101.72

The most important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate June +0.9%

14:00 U.S. JOLTs Job Openings May 4455 4530

17:45 U.S. FOMC Member Narayana Kocherlakota

19:00 U.S. Consumer Credit May 26.8 21.3

20:30 U.S. API Crude Oil Inventories July -0.9