- Foreign exchange market. Asian session: the yen traded higher against the U.S. dollar due to increasing demand for safe-haven currency as the United States announced new sanctions against Russia

Market news

Foreign exchange market. Asian session: the yen traded higher against the U.S. dollar due to increasing demand for safe-haven currency as the United States announced new sanctions against Russia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index May -0.1% +0.2%

01:30 Australia NAB Quarterly Business Confidence Quarter II 6 6

01:55 Australia RBA Assist Gov Edey Speaks

The U.S. dollar traded mixed against the most major currencies. The U.S. dollar remained supported by Tuesday's comments by the Fed Chair Janet Yellen. The Fed Chair said the economy in the U.S. is continuing to improve but the recovery is not yet complete. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

The New Zealand dollar traded lower against the U.S dollar. The U.S. dollar still supported by Tuesday's comments by the Fed Chair Janet Yellen. Yesterday's weaker-than-expected consumer inflation in New Zealand dollar also weighed on the kiwi. New Zealand's consumer price index increased 0.3% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the previous quarter. Market participants speculate if the Reserve Bank of New Zealand will hike its interest rate this year.

No major economic reports were released in New Zealand.

The Australian dollar traded mixed against the U.S. dollar after the release of economic data in Australia. The National Australia Bank business confidence index declined to 6 in the second quarter from 7 in the first quarter. The first quarter's figure was revised up from 6.

The Conference Board leading index for Australia increased by 0.2% in May, after a 0.2% decrease in April. April's figure was revised down from a 0.1% fall.

The Japanese yen traded higher against the U.S. dollar due to increasing demand for safe-haven currency as the United States announced new sanctions against Russia. No major economic reports were released in Japan.

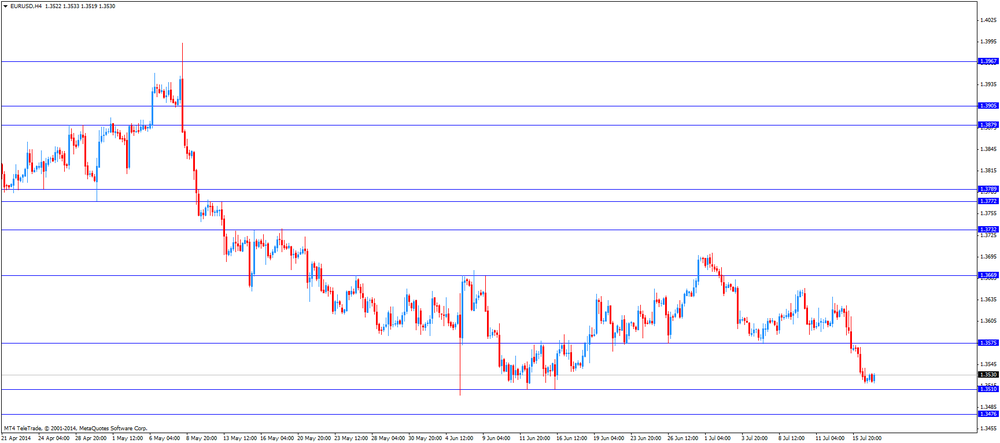

EUR/USD: the currency pair traded mixed

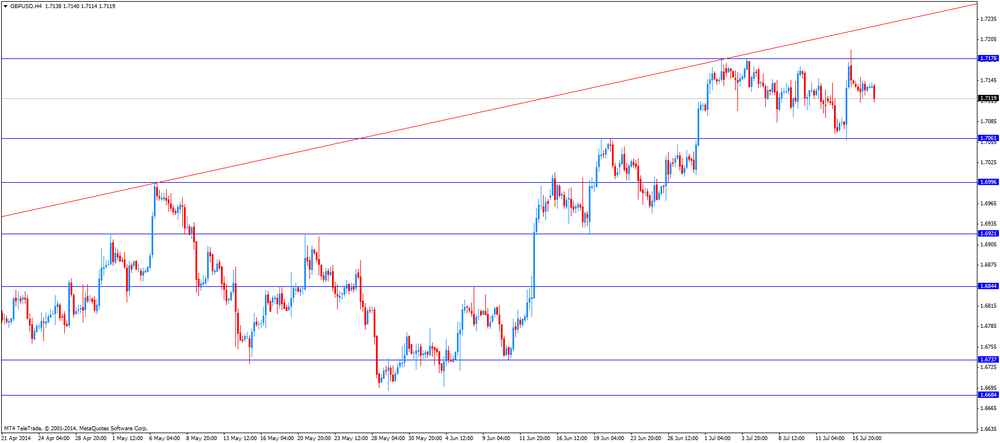

GBP/USD: the currency pair

USD/JPY: the currency pair declined to Y101.45

The most important news that are expected (GMT0):

09:00 Eurozone Harmonized CPI June -0.1%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) June +0.5% +0.5%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y June +0.8% +0.8%

12:30 Canada Foreign Securities Purchases May 10.13 14.23

12:30 U.S. Initial Jobless Claims July 304 310

12:30 U.S. Building Permits, mln June 0.99 1.04

12:30 U.S. Housing Starts, mln June 1.00 1.02

14:00 U.S. Philadelphia Fed Manufacturing Survey July 17.8 15.6

23:50 Japan Monetary Policy Meeting Minutes