- Foreign exchange market. Asian session: the Japanese yen traded higher against the U.S. dollar after Bank of Japan’s minutes

Market news

Foreign exchange market. Asian session: the Japanese yen traded higher against the U.S. dollar after Bank of Japan’s minutes

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:00 Eurozone Current account, adjusted, bln May 21.6 (Revised from 21.5) 24.3 19.5

The U.S. dollar traded mixed against the most major currencies. The U.S. dollar was supported by concerns over tensions in Ukraine and a ground campaign in Gaza.

The New Zealand dollar traded lower against the U.S dollar due to decreasing demand for risk assets as the crash of a Malaysian passenger jet in eastern Ukraine and a ground offensive in Gaza weighed on markets. Market participants are awaiting the next Reserve Bank of New Zealand's interest decision. Recently released weak economic data from New Zealand could mean that the RBNZ will keep unchanged its interest rate.

No major economic reports were released in New Zealand.

The Australian dollar climbed against the U.S. dollar in the absence of any major economic reports in Australia.

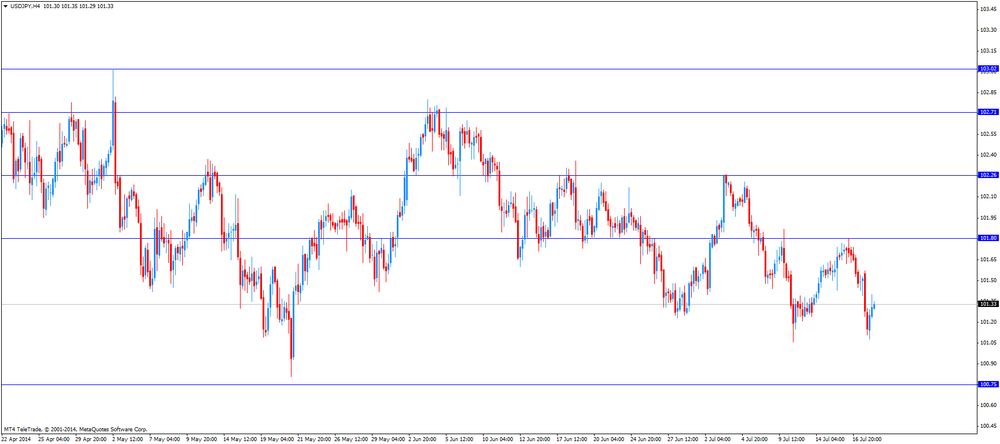

The Japanese yen traded lower against the U.S. dollar after Bank of Japan's minutes. Members of BoJ's board agreed that the economic recovery will remain on track. The BoJ added that consumer inflation were expected to continue rising moderately and will slow only temporarily.

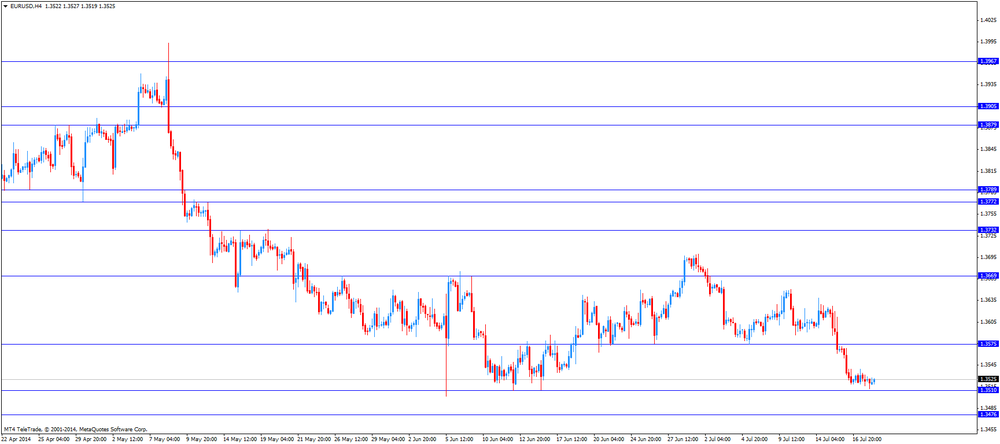

EUR/USD: the currency pair traded mixed

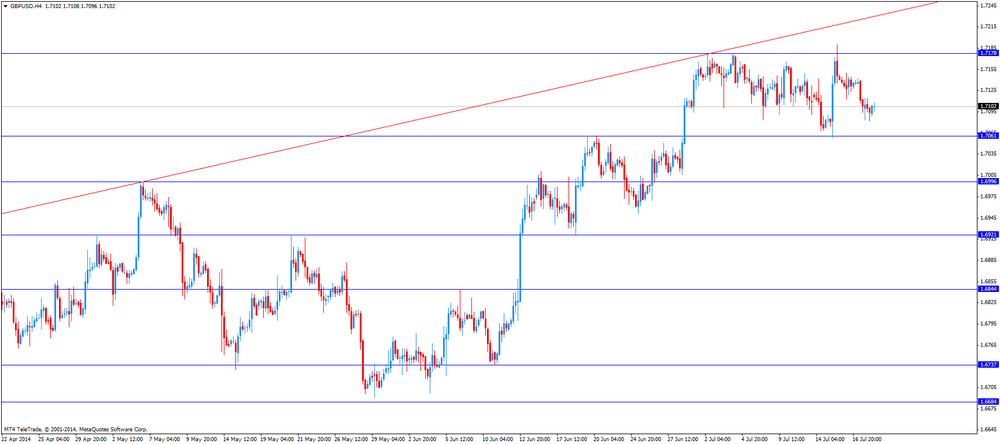

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair was up to Y101.40

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m May +1.2% +0.7%

12:30 Canada Consumer Price Index m / m June +0.5% +0.4%

12:30 Canada Consumer price index, y/y June +2.3%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m June +0.5% +0.4%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y June +1.7%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) July 82.5 83.5

14:00 U.S. Leading Indicators June +0.5% +0.6%