- Foreign exchange market. Asian session: the Australian dollar rose against the U.S. dollar after the strong Westpac Melbourne Institute Index of Consumer Sentiment for Australia

Market news

Foreign exchange market. Asian session: the Australian dollar rose against the U.S. dollar after the strong Westpac Melbourne Institute Index of Consumer Sentiment for Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence August +1.9% +3.8%

01:30 Australia Wage Price Index, q/q Quarter II +0.7% +0.8% +0.6%

01:30 Australia Wage Price Index, y/y Quarter II +2.6% +2.6%

05:30 China Retail Sales y/y July +12.4% +12.5% +12.2%

05:30 China Fixed Asset Investment July +17.3% +17.4% +17.0%

05:30 China Industrial Production y/y July +9.2% +9.1% +9.0%

06:00 Germany CPI, m/m (Finally) July +0.3% +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) July +0.8% +0.8% +0.8%

06:45 France CPI, m/m July 0.0% -0.2% -0.3%

06:45 France CPI, y/y July +0.5% +0.6%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June +0.7% +0.6%

08:30 United Kingdom Average Earnings, 3m/y June +0.3% -0.1% -0.2%

08:30 United Kingdom Claimant count July -36.3 -29.7 -33.6

08:30 United Kingdom Claimant Count Rate July 3.1% 3.0%

08:30 United Kingdom ILO Unemployment Rate June 6.5% 6.4% 6.4%

The U.S. dollar traded mixed to higher against the most major currencies. Investors continue to monitor geopolitical tensions in Iraq and Ukraine.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar rose against the U.S. dollar after the strong Westpac Melbourne Institute Index of Consumer Sentiment for Australia. The index climbed 3.8% in August, after a 1.9% gain in July.

Australia's Wage Price Index increased 0.6% in the second quarter, missing expectations for a 0.8% rise, after a 0.7% gain in the first quarter.

On a yearly basis, the Wage Price Index in Australia rose 2.6% in the second quarter, after a 2.6% increase in the first quarter.

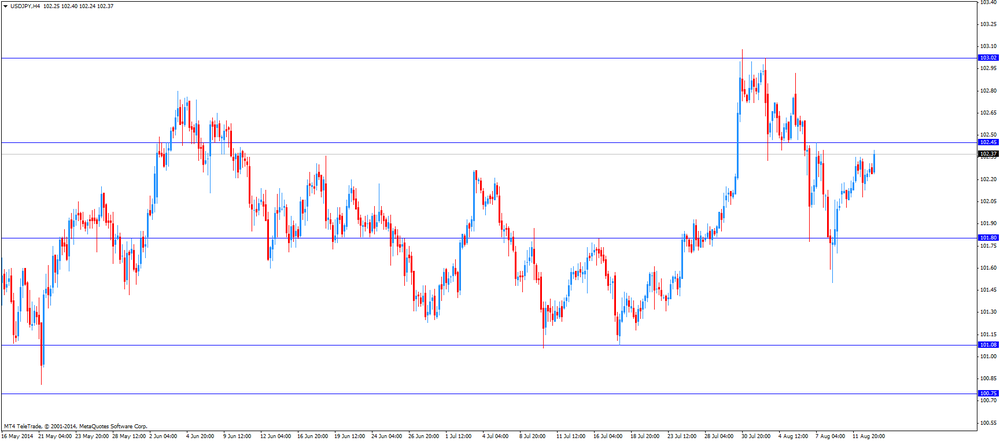

The Japanese yen traded mixed against the U.S. dollar after the disappointing data from Japan. Japan's preliminary gross domestic product dropped 1.7% in the second quarter, in line with expectations, after a 1.5% gain in the first quarter. The first quarter figure was revised down from a 1.6% rise.

The decline of GDP was driven by the tax hike in April.

On a yearly basis, Japan's preliminary gross domestic product slid 6.8% in the second quarter, after a 6.1% rise in the first quarter. The first quarter figure was revised down from a 6.7% increase.

The Bank of Japan released minutes from the BoJ's meeting on July 14 and 15. The central bank said that the country's economic recovery remains on track. The BoJ added that it will continue with the quantitative and qualitative monetary easing, aiming to achieve the inflation target of 2%.

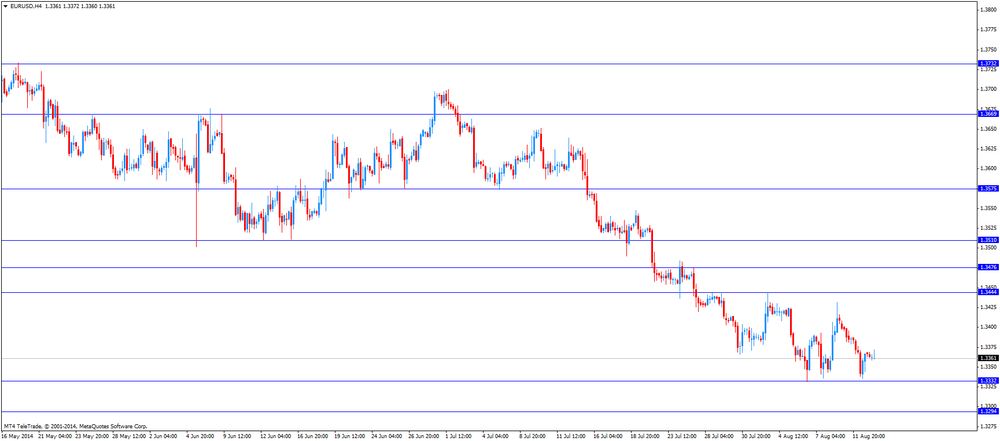

EUR/USD: the currency pair decreased to $1.3360

GBP/USD: the currency pair fell to $1.6799

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

09:00 Eurozone Industrial production, (MoM) June -1.1% +0.5%

09:00 Eurozone Industrial Production (YoY) June +0.5%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August 0.1

09:30 United Kingdom BOE Inflation Letter Quarter III

09:30 United Kingdom BOE Gov Mark Carney Speaks

12:30 U.S. Retail sales July +0.2% +0.2%

12:30 U.S. Retail sales excluding auto July +0.4% +0.4%

13:05 U.S. FOMC Member Dudley Speak

14:30 U.S. Crude Oil Inventories August -1.8

22:30 New Zealand Business NZ PMI July 53.3

22:45 New Zealand Retail Sales, q/q Quarter II +0.7% +1.0%

22:45 New Zealand Retail Sales ex Autos, q/q Quarter II +0.8%

23:50 Japan Core Machinery Orders June -19.5% +15.5%

23:50 Japan Core Machinery Orders, y/y June -14.3%