- Foreign exchange market. Asian session: the New Zealand dollar traded lower against the U.S dollar after the current account data from New Zealand

Market news

Foreign exchange market. Asian session: the New Zealand dollar traded lower against the U.S dollar after the current account data from New Zealand

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:45 New Zealand Current Account Quarter II 1.41 -1.04 -1.06

10:30 United Kingdom Average Earnings, 3m/y July -0.2% +0.5% +0.6%

10:30 United Kingdom Average earnings ex bonuses, 3 m/y July +0.6% +0.7%

10:30 United Kingdom Claimant count August -37.4 Revised From -33.6 -29.7 -37.2

10:30 United Kingdom Claimant Count Rate August 3.0% 2.9%

10:30 United Kingdom ILO Unemployment Rate July 6.4% 6.3% 6.2%

10:30 United Kingdom Bank of England Minutes

The U.S. dollar traded mixed against the most major currencies on speculation the Fed will start to hike its interest rate sooner than expected. Market participants are awaiting the Fed's interest rate decision today.

Market participants expect the Fed will cut its asset purchase program by another $10 billion.

The New Zealand dollar traded lower against the U.S dollar after the current account data from New Zealand. New Zealand's current account deficit was NZ$1.06 billion in the second quarter, down from a surplus of NZ$1.41 billion in the first quarter. Analysts had expected the current account deficit of NZ$1.04 billion.

The auction on Fonterra's GlobalDairyTrade platform showed dairy prices rose from a two-year low.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia.

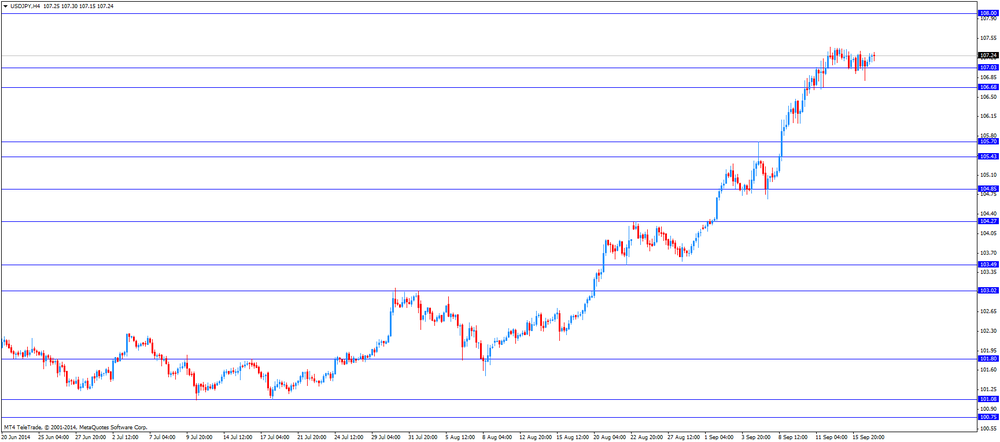

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

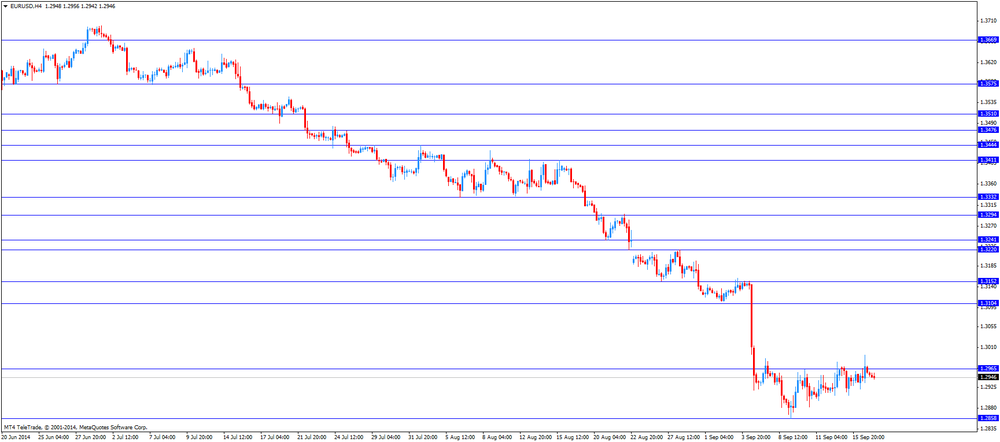

EUR/USD: the currency pair traded mixed

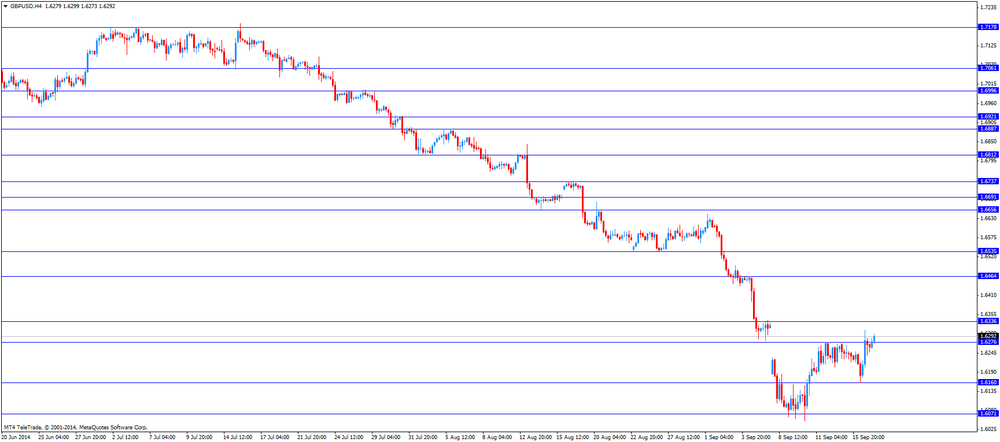

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

11:00 Eurozone Harmonized CPI, Y/Y (Finally) August +0.3% +0.3%

14:30 U.S. Current account, bln Quarter II -111 -114

14:30 U.S. CPI, m/m August +0.1% +0.1%

14:30 U.S. CPI, Y/Y August +2.0%

14:30 U.S. CPI excluding food and energy, m/m August +0.1% +0.2%

14:30 U.S. CPI excluding food and energy, Y/Y August +1.9%

16:00 U.S. NAHB Housing Market Index September 55 56

20:00 U.S. FOMC Economic Projections

20:00 U.S. FOMC Statement

20:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

20:00 U.S. FOMC QE Decision 25 15

20:30 U.S. Federal Reserve Press Conference