- Foreign exchange market. European session: the Swiss franc rose against the U.S. dollar after the Swiss National Bank’s interest rate decision

Market news

Foreign exchange market. European session: the Swiss franc rose against the U.S. dollar after the Swiss National Bank’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Bulletin

06:00 Switzerland Trade Balance August 3.98 2.56 1.39

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

08:00 United Kingdom Scottish Independence Vote

08:30 United Kingdom Retail Sales (MoM) August +0.1% +0.4% +0.4%

08:30 United Kingdom Retail Sales (YoY) August +2.5% Revised From +2.6% +3.9%

09:15 Eurozone Targeted LTRO 174 82.6

10:00 United Kingdom CBI industrial order books balance September 11 9 -4

The U.S. dollar traded mixed to lower against the most major currencies ahead of the speech of the Fed Chair Janet Yellen and the U.S. economic data.

Housing starts in the U.S. are expected to decline to 1.040 million units in August from 1.090 million units in July.

The number of building permits is expected to decline to 1.040 million units in August from 1.060 million in July.

The number of initial jobless claims in the U.S. is expected to decline by 3,000 to 312,000.

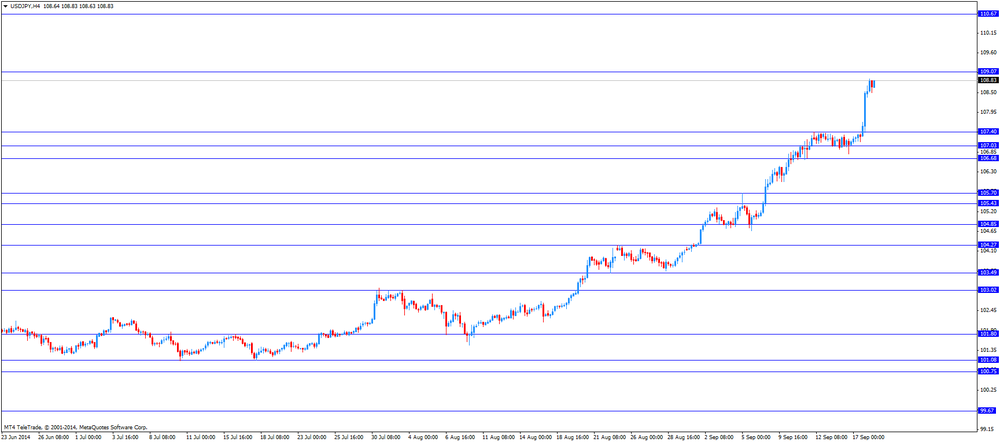

Yesterday's results of the Fed's monetary policy meeting weighed on the greenback. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The euro traded mixed against the U.S. dollar. The European Central Bank said today it allotted €82.6 billion in its new Targeted Long Term Refinancing Operation (TLTRO). Analysts had expected €174 billion.

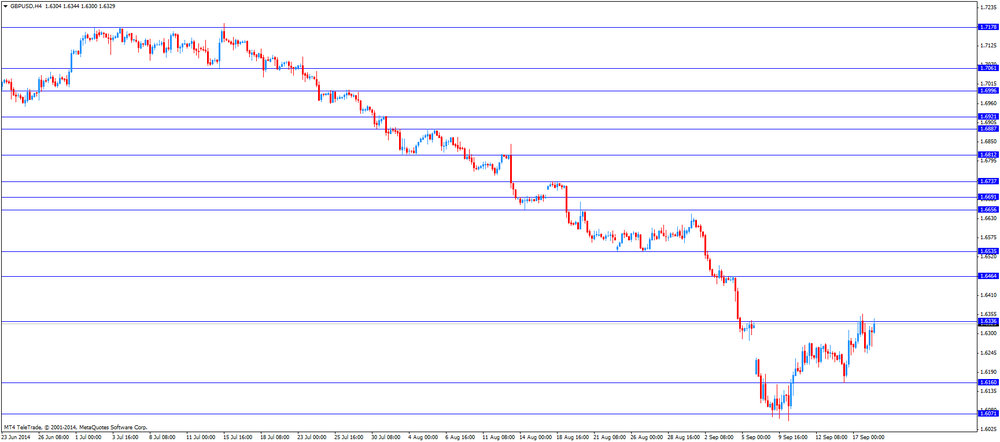

The British pound traded higher against the U.S. dollar. The Scotland's independence referendum weighed on the pound.

The U.K. retail sales increased 0.4% in August, in line with expectations, after a flat reading in July. July's figure was revised down from a 0.1% rise.

On a yearly basis, retail sales in the U.K. climbed 3.9% in August, after a 2.5% gain in July. July's figure was revised down from a 2.6% increase.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance dropped to -4% in September from +11% in August, missing expectations for a decrease to +9%.

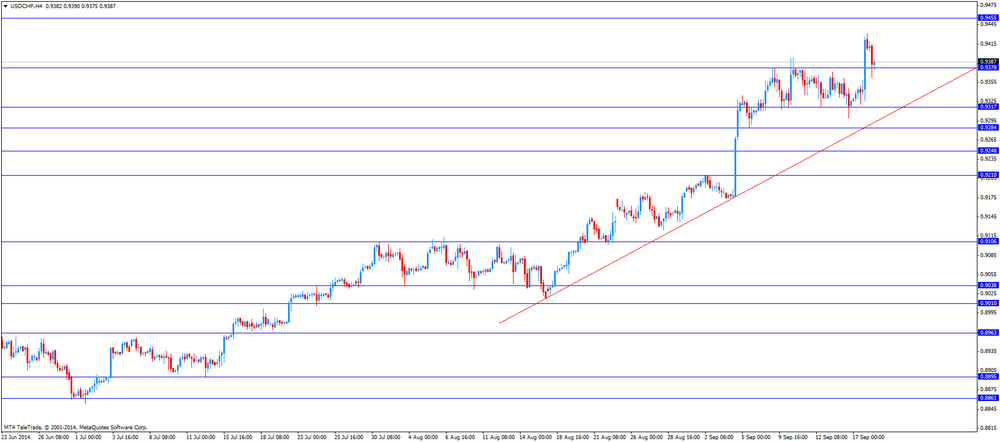

The Swiss franc rose against the U.S. dollar after the Swiss National Bank's (SNB) interest rate decision. The SNB kept its interest rate unchanged at 0.00 - 0.25% and also kept the exchange rate floor unchanged at 1.20 francs per euro.

Switzerland's central bank said "will continue to enforce the minimum exchange rate with the utmost determination".

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.6344

USD/JPY: the currency pair traded mixed

USD/CHF: the currency pair declined to CHF0.9362

The most important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases June -1.07 2.47

12:30 U.S. Building Permits, mln August 1.06 Revised From 1.05 1.04

12:30 U.S. Housing Starts, mln August 1.09 1.04

12:30 U.S. Initial Jobless Claims September 315 312

12:45 U.S. Fed Chairman Janet Yellen Speaks

14:00 U.S. Philadelphia Fed Manufacturing Survey September 28.0 22.8