- Foreign exchange market. Asian session: the Japanese yen hits 6-year low against the U.S. dollar as 55% of Scottish voters said “no” to independence

Market news

Foreign exchange market. Asian session: the Japanese yen hits 6-year low against the U.S. dollar as 55% of Scottish voters said “no” to independence

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:00 New Zealand Credit Card Spending August +4.5% +4.2%

04:30 Japan All Industry Activity Index, m/m July -0.4% +0.4% -0.2%

06:00 Germany Producer Price Index (MoM) August -0.1% -0.1% -0.1%

06:00 Germany Producer Price Index (YoY) August -0.8% -0.8%

08:00 Eurozone Current account, adjusted, bln July 18.6 Revised From 13.1 14.3 18.7

The U.S. dollar traded higher against the most major currencies despite yesterday's mixed U.S. economic data. The U.S. dollar remained supported by the results of the Fed's monetary policy meeting on Wednesday. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed raised its estimates for interest rate. The U.S. central bank said interest rate will be 3.75% at the end of 2017.

The U.S. dollar was also supported by the results of the Scotland's independence referendum. 55% of voters said "no" to independence.

The New Zealand dollar traded slightly lower against the U.S dollar. Market participants are awaiting the general election on Saturday. The ruling centre-right National party is expected to win.

Credit card spending in New Zealand rose 4.2% in August, after a 4.5% in July.

The Australian dollar traded slightly lower against the U.S. dollar in the absence of any major economic reports from Australia.

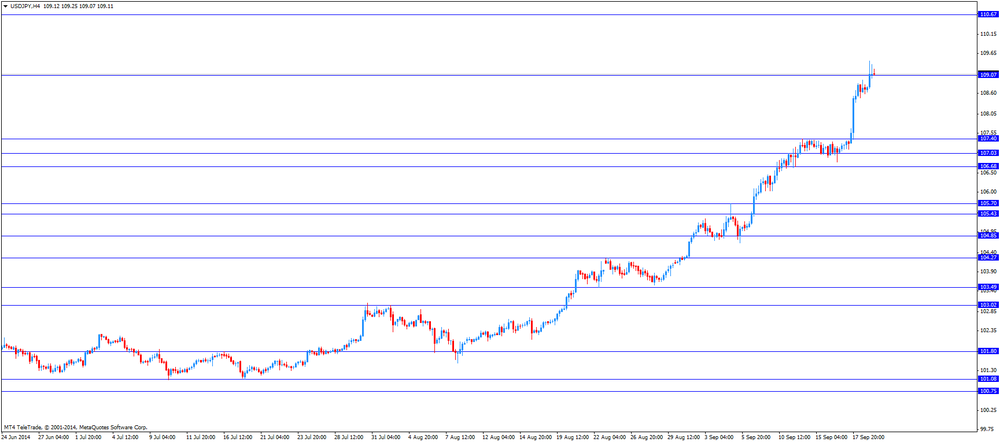

The Japanese yen hits 6-year low against the U.S. dollar as 55% of Scottish voters said "no" to independence.

The all industry activity index in Japan declined 0.2% in July, missing expectations for a 0.4% gain, after a 0.3% fall in June. June's figure was revised up from a 0.4% drop.

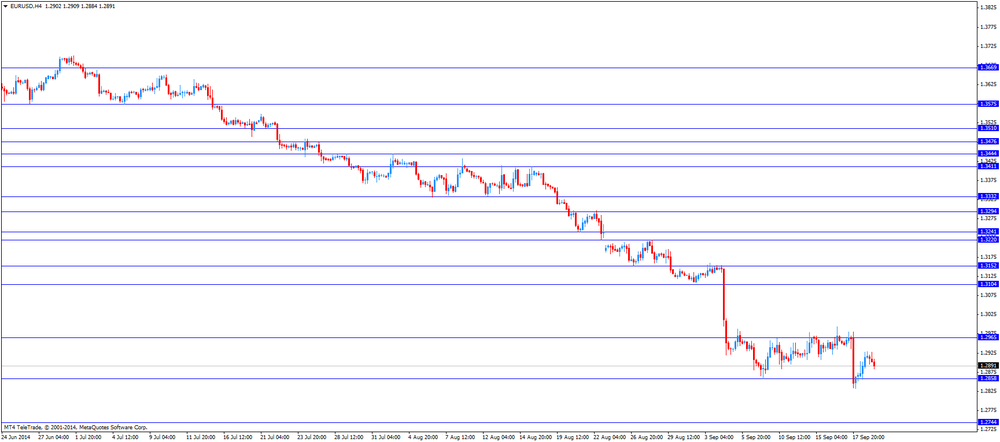

EUR/USD: the currency pair fell to $1.2896

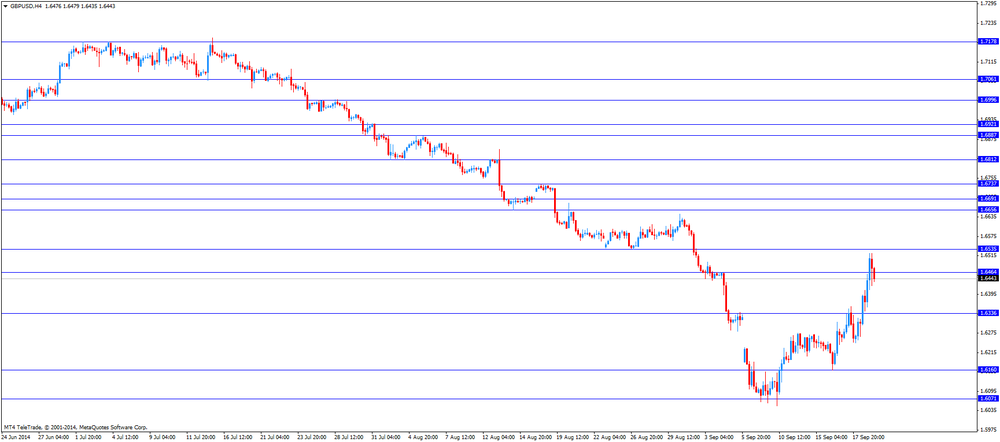

GBP/USD: the currency pair decreased to $1.6422

USD/JPY: the currency pair climbed to Y109.45

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m July +0.6% +0.8%

12:30 Canada Consumer Price Index m / m August -0.2% -0.1%

12:30 Canada Consumer price index, y/y August +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m August -0.1% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y August +1.7%