- Foreign exchange market. European session: the U.S. dollar traded mixed to higher against the most major currencies as Fed's monetary policy meeting on Wednesday still supported the greenback

Market news

Foreign exchange market. European session: the U.S. dollar traded mixed to higher against the most major currencies as Fed's monetary policy meeting on Wednesday still supported the greenback

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:00 New Zealand Credit Card Spending August +4.5% +4.2%

04:30 Japan All Industry Activity Index, m/m July -0.4% +0.4% -0.2%

06:00 Germany Producer Price Index (MoM) August -0.1% -0.1% -0.1%

06:00 Germany Producer Price Index (YoY) August -0.8% -0.8%

08:00 Eurozone Current account, adjusted, bln July 18.6 Revised From 13.1 14.3 18.7

The U.S. dollar traded mixed to higher against the most major currencies despite yesterday's mixed U.S. economic data. The U.S. dollar remained supported by the results of the Fed's monetary policy meeting on Wednesday. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed raised its estimates for interest rate. The U.S. central bank said interest rate will be 3.75% at the end of 2017.

The U.S. dollar was also supported by the results of the Scotland's independence referendum. 55% of voters said "no" to independence.

The euro declined against the U.S. dollar. Eurozone's adjusted current account surplus climbed to 18.7 billion euros in July from a surplus of 18.6 billion euros in June, beating expectations for a decline to a surplus of 14.3 billion euros. June's figure was revised up from a surplus of 13.1 billion euros.

German producer price index fell 0.1% in August, in line with expectations, after a 0.1% decrease in July.

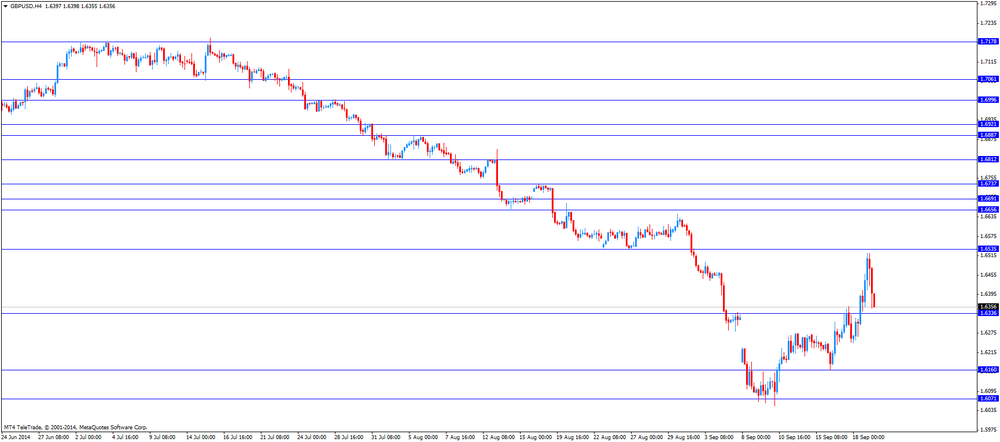

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian consumer price index.

The consumer price index in Canada is expected to decline 0.1% in August, after a 0.2% drop in July.

The core consumer price index in Canada is expected to rise 0.2% in August, after a 0.1% decrease in July.

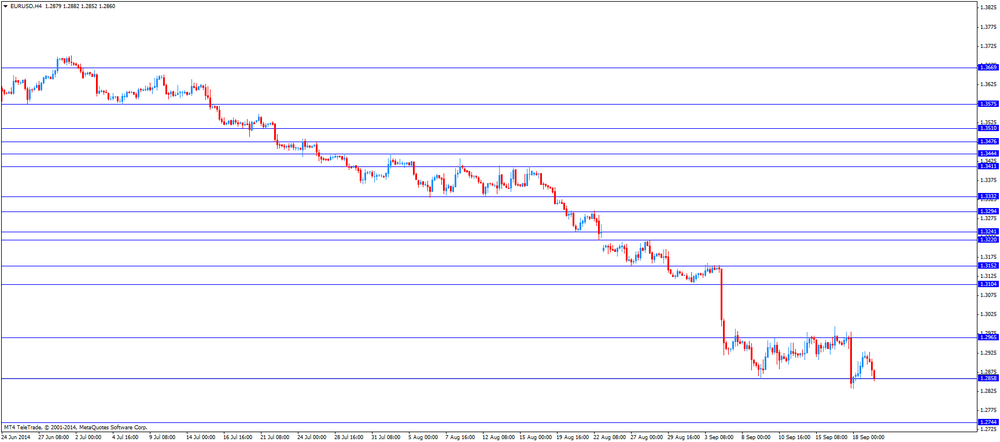

EUR/USD: the currency pair declined to $1.2852

GBP/USD: the currency pair fell to $1.6353

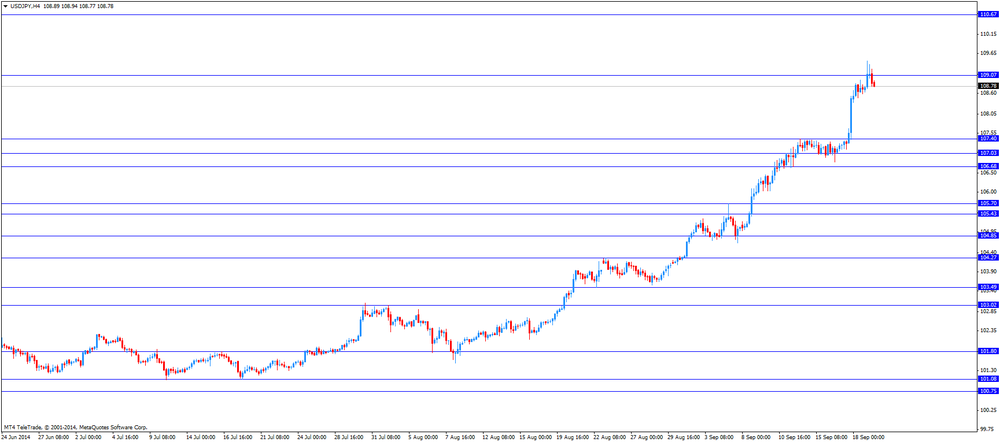

USD/JPY: the currency pair decreased to Y108.77

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m July +0.6% +0.8%

12:30 Canada Consumer Price Index m / m August -0.2% -0.1%

12:30 Canada Consumer price index, y/y August +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m August -0.1% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y August +1.7%